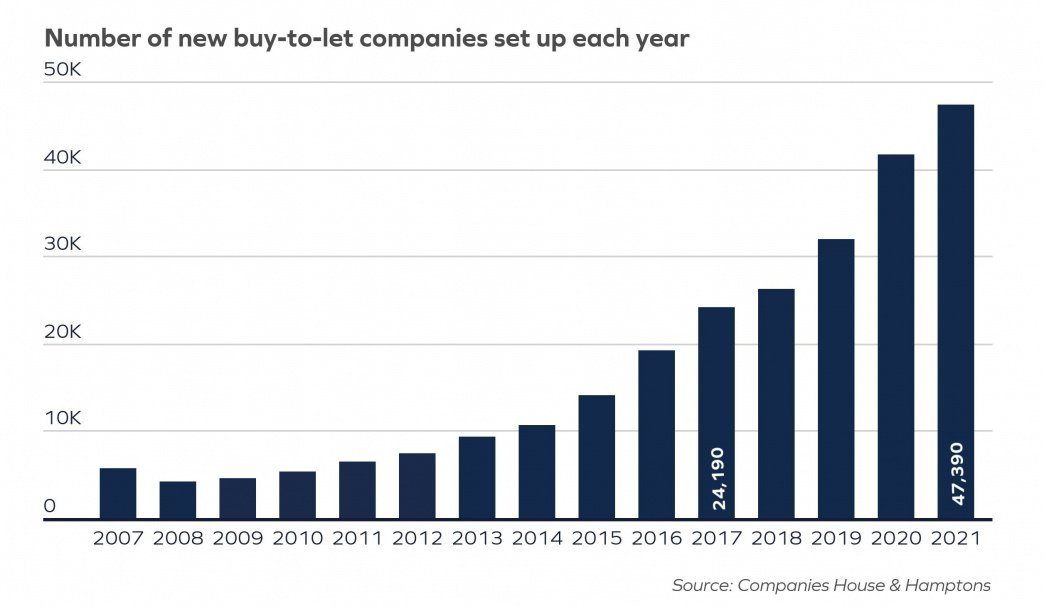

Record 47,400 buy-to-let limited companies established in 2021: Hamptons

Over the last four years, the number of landlords putting their buy-to-let properties into a company rather than holding them in their personal name has doubled. This is according to research by Hamptons.

Analysis of Companies House data found 47,400 new UK buy-to-let companies were incorporated in 2021, the highest number on record.

Hamptons says tax changes have predominantly driven the rise in limited companies and in particular the Section 24 changes that came into play in 2017. It says since then investors with properties in their names have no longer claimed mortgage interest as an expense.

While individual landlords are taxed on turnover, company landlords are taxed on profit. This has meant that for some landlords – particularly those who are higher rate taxpayers – it has become more profitable to move their buy-to-let(s) into a company.

If you are planning to set up a limited company, it is advisable to speak to an accountant to ensure it makes financial sense.

Aaron Strutt, product director at Trinity Financial, says: "More of the lenders have started to offer limited company buy-to-let mortgages with competitively priced rates. The bigger banks and building societies tend to offer the cheapest deals, including BM Solutions and The Mortgage Works."

Hamptons data shows the number of buy-to-let companies in the UK passed the 200,000 mark in 2020 and rose to 269,300 in 2021.

Source: Hamptons

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation