How much would a £500,000 mortgage cost?

If you're looking to borrow £500,000 over 30 years with an interest rate of 3.99%, that could cost you £1,662.50 per month with an interest-only mortgage. This rises to £2,384.19 on full capital repayment.

Find out how much you can borrow using our maximum loan calculator.

Try our calculatorTrinity Financial has a wealth of experience in arranging finance for both property purchases and re-mortgages.

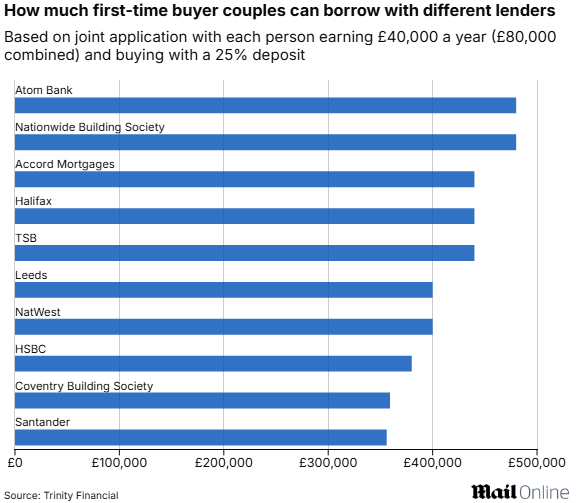

We have access to over 70 mortgage lenders and, also, the mortgages being offered by smaller building societies and some fantastic private banks. We also work with a range of specialist lenders.

We understand that, in today's fast moving property market, our clients need their mortgage adviser to act fast, also to offer an efficient and expert service.

In addition, Trinity aims to ensure that our clients take advantage of the increasing competition between banks and building societies to secure the best rates for you.

Buying a property

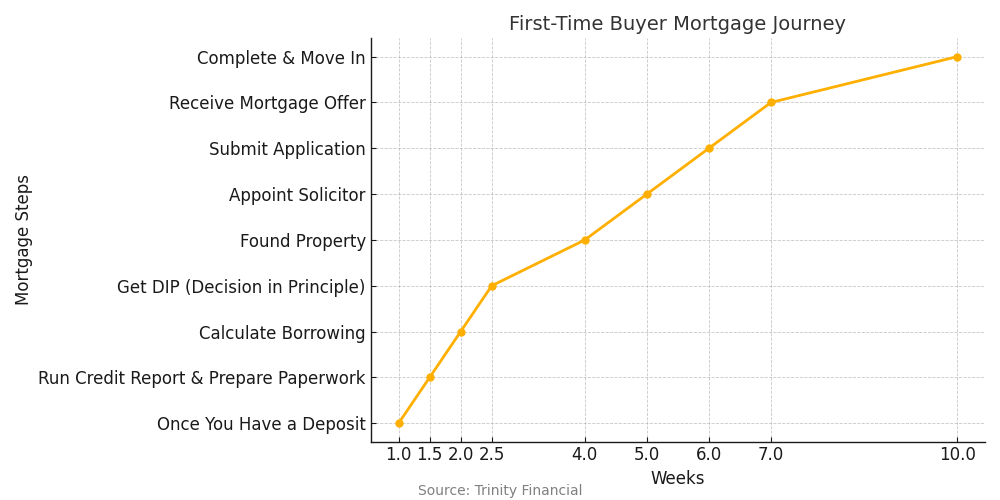

Each of our expert mortgage advisers understands that purchasing a property - particularly in London and the south-east - is becoming an increasingly time-sensitive and complicated process.

When speed is vital, Trinity will approach only the lenders in a position to process a mortgage application quickly to avoid possible delays in receiving your mortgage offer.

Trinity works with your estate agent or vendor

Firstly, we complete our initial fact finding and approach a suitable mortgage lender on your behalf. Then, we speak to your estate agent or vendor to confirm that you are in the process of securing a mortgage.

This is because estate agents are keen to know property buyers are in a good financial position to proceed with the purchase as quickly as possible. Therefore, we work with your agent both to assure them your application is going through and your property valuation is booked in.

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Talk to an Expert Mortgage QuestionnaireResidential mortgages

Re-mortgaging to secure a lower rate

We will search the mortgage market to find the most competitively priced loan appropriate for you.

Trinity can also help clients to re-mortgage their existing properties to generate deposits for new property purchases, home extensions, or to pay off secured and unsecured debts.

Call Trinity on 020 7016 0790 to secure a residential mortgage.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage

Aaron Strutt's Mortgage News

Aaron Strutt's Mortgage News