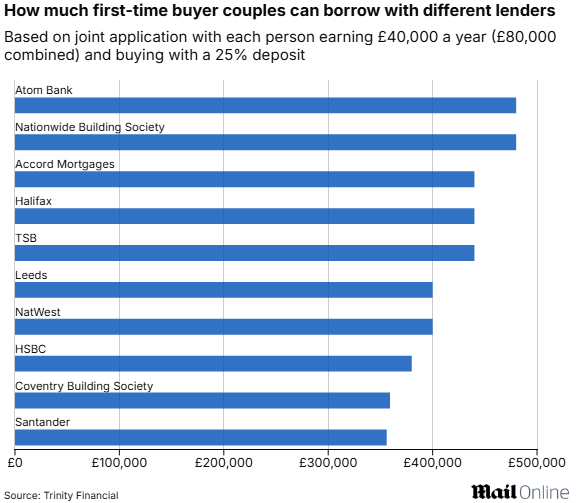

How much can I borrow?

If you're looking to borrow £400,000 over 30 years with an interest rate of 3.99%, that could cost you £1,907.36 per month on capital repayment or £1,330 on an interest-only mortgage.

Find out how much you can borrow with our mortgage calculator.

Try our Mortgage CalculatorInterest-only mortgages have increased in popularity with Trinity's clients who are keen to secure the lowest possible monthly payments.

Trinity Financial has access to a wide range of banks and building societies offering interest-only mortgages to borrowers with differing financial situations.

Interest-only mortgages are no longer niche products and so many of the lenders are keen to offer them.

Interest-only qualification

A number of banks have improved their interest-only criteria to attract borrowers.

Trinity’s experts will assess your situation to understand how they can help. Many lenders offer interest-only to borrowers earning over £75,000 or £100,000 per year, but there are also options for those with equity in the property.

The sale of the property is increasingly being used as a repayment vehicle, although some lenders may still expect clients to regularly pay into an ISA or pension fund to generate enough income to repay the mortgage. However, if you already have buy-to-let properties, you may also be able to use them as a repayment vehicle.

Interest-only mortgages have lower monthly repayments than capital repayment mortgages because you are not paying back any of the total sum you borrowed.

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Talk to an Expert Mortgage QuestionnaireInterest-only mortgages

Remortgaging onto interest only

Banks and building societies provide interest-only remortgages to borrowers with sufficient equity in their homes.

More homeowners are remortgaging on to interest-only to reduce their outgoings and refinance when their fixed or tracker rate is coming to an end.

We recommend you regularly check that your interest-only mortgage repayment plan is on track.

Your home may be repossessed if you do not keep up repayments on your mortgage.

Aaron Strutt's Mortgage News

Aaron Strutt's Mortgage News