.jpg)

How much would a £500,000 mortgage cost?

If you're looking to borrow £500,000 over 30 years with an interest rate of 3.99%, that could cost you £1,662.50 per month with an interest-only mortgage. This rises to £2,384.19 on full capital repayment.

Find out how much you can borrow using our maximum loan calculator.

Try our calculatorTrinity Financial's advisers have a wealth of experience arranging finance for new build houses and off-plan homes.

Our specialists will source the most suitable and competitively priced new build mortgages and confirm how much you can borrow.

They will also provide swift agreements in principle to help you secure a property.

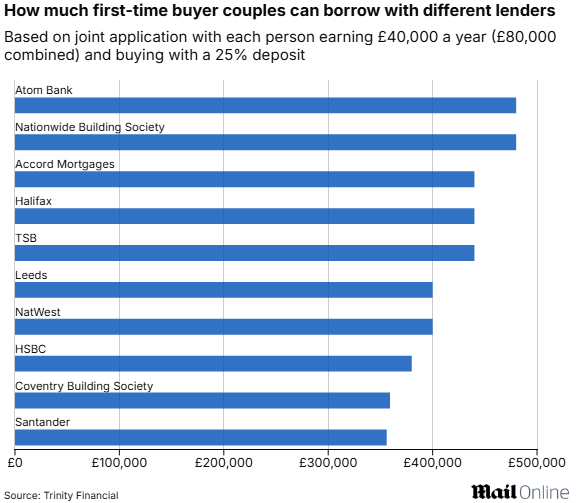

We have access to over 50 leading lenders, plus the mortgages offered by smaller building societies and specialist providers.

Access to so many providers allows us to manage the lenders new build exposure limits.

We consistently arrange:

· Ten per cent deposit mortgages for new build houses

· Off-plan mortgages with no charge for a standard property valuation

· Nine-month mortgage offers for new build applications with three-month extensions

· Lower mortgage rates for energy-efficient homes

As new build specialists, Trinity Financial work closely with developers to find the right mortgage deals.

Call Trinity Financial on 020 7016 0790 to secure a new build mortgage

Your home may be repossessed if you do not keep up repayments on your mortgage

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Talk to an Expert Mortgage Questionnaire

Aaron Strutt's Mortgage News

Aaron Strutt's Mortgage News