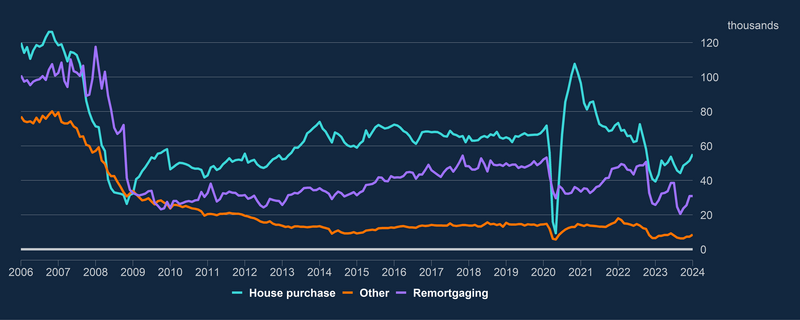

Mortgage approvals up for fourth month in a row

Net mortgage approvals for house purchases rose from 51,500 in December to 55,200 in January. Net approvals for remortgaging remained stable at 30,900 in January.

January marks the fourth consecutive increase and approvals are now at their highest level since June 2023 (53,953).

The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages fell by 9 basis points, to 5.19% in January.

Households deposited, on net, £6.8 billion with banks and building societies in January. While net borrowing of consumer credit by individuals rose to £1.9 billion in January, from £1.3 billion in December.

Aaron Strutt, product director at Trinity Financial, says: "The mortgage market has been busier since mortgage rates came down and there has been more confidence in the housing market.

"Over the last couple of weeks, rates have increased and the sub-4% deals for new customers have been withdrawn. There are still five-year fixes priced around 4.2% and two-year fixes priced around 4.4%."

January property transactions at the lowest level since 2013: HMRC

Residential property transactions fell by 20% in January compared to December 2023, and remain 10% lower than in January 2023, according to the latest HMRC statistics.

HMRC says this decline is typical for January, where monthly falls tend to be between 20% and 30%.

**The graph above shows Mortgage approvals, seasonally adjusted.

Call Trinity Financial on 020 7016 0790 to secure a mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage