First Time Buyer Mortgage Broker and Advice

Tags: First-time buyers, Residential mortgages

Quick Summary

Thinking about purchasing your first home? With so many factors to consider, the process can feel daunting. It’s not always easy to know exactly how to take the first step. Trinity Financial's brokers are on hand to help guide you through the whole process, with expert mortgage advice from start to finish. But for now, here’s what you need to know as a first-time buyer - and how to get moving.

New research from the Building Societies Association shows that many aspiring first-time buyers could be closer to owning their own home than they think, but too many are ruling themselves out before exploring what is possible. The findings show that almost half (47%) of people who want to buy their own home have never spoken to a lender or mortgage broker to check what options are available to them.

Buying your first home is one of life’s biggest milestones. It’s exciting — but it can also feel overwhelming. Deposits, credit checks, mortgage types, and mortgage affordability rules… where do you even begin?

At Trinity Financial, we specialise in helping first-time buyers move from “just browsing” online to collecting the keys with confidence. This guide walks you through everything you need to know.

First-time buyers are making up an increasingly large part of the property purchase market. Research from Connells shows first-time buyers purchased 34.3% of homes sold across Great Britain in January (2026) - the highest share recorded in any January since its records began in 2006. In London, first-time buyers now account for 48.3% of purchases, up from 22.4% a decade ago.

What qualifies you as a first-time buyer?

You’re considered a first-time buyer if:

-

You’ve never owned property anywhere in the world

-

You’re buying to live in the property (not as a buy-to-let investment)

-

Sometimes if you’re buying with someone who has owned before

This matters because first-time buyers can benefit from stamp duty relief and the qualification rules for many mortgage schemes on the market, helping them get on the property ladder.

How much deposit do you need?

Example on a £300,000 home:

-

5% deposit = £15,000

-

10% deposit = £30,000

-

15% deposit = £45,000

A larger deposit can improve your chances of approval and unlock better interest rates while also reducing monthly repayments.

The first-time buyer mortgage process (step-by-step)

1️⃣ Work out your budget

A mortgage adviser will assess your affordability and calculate how much you may be able to borrow.

2️⃣ Get a Mortgage in Principle (MIP)

This shows sellers you’re serious and gives you a realistic price range.

3️⃣ Start house hunting

Once your offer is accepted, your full mortgage application begins.

4️⃣ Mortgage application & valuation

The lender reviews your finances and arranges a property valuation.

5️⃣ Mortgage Offer issued

Your solicitor handles legal work, contracts are exchanged, and you complete.

From application to completion typically takes 8–12 weeks.

Which mortgages are best for first-time buyers?

There’s no universal “best” mortgage — it depends on your goals.

Fixed Rate Mortgage

Your payments stay the same for a set period (often 2, 3 or 5 years).

Tracker Mortgage

Tracks the Bank of England base rate.

Variable Rate Mortgage

Payments can rise or fall depending on the lender’s rate.

Offset Mortgage

Links savings to your mortgage to reduce interest charged.

Most first-time buyers choose fixed rates for stability.

Stamp duty for first-time buyers

In England & Northern Ireland:

-

No Stamp Duty on properties up to £425,000

-

Reduced rates up to £625,000

This can save thousands — money that can go towards furnishing your new home instead.

First-time buyer checklist

You can use this as a downloadable blog asset:

✅ Before you start

-

Check your credit report

-

Reduce outstanding debts

-

Save for deposit + fees (legal, survey, moving costs)

✅ Before applying

-

Gather last 3 months’ payslips

-

Bank statements

-

Proof of ID

-

Proof of deposit source

✅ After offer accepted

-

Appoint solicitor

-

Finalise mortgage application

-

Arrange home insurance (required before exchange)

Frequently Asked Questions

How much can I borrow as a first-time buyer?

Typically 4–4.5x your annual income (subject to affordability checks).

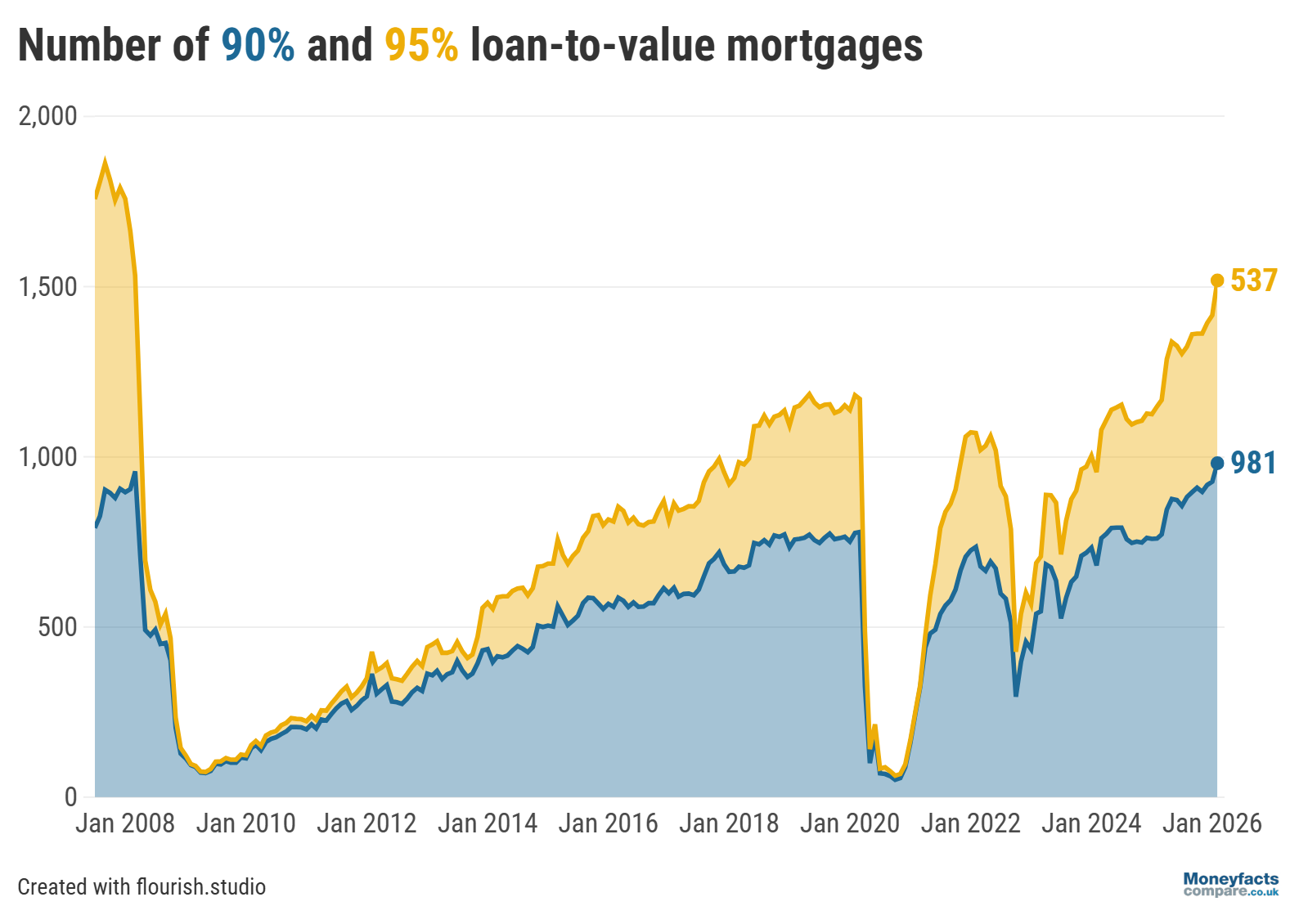

Can I get a mortgage with a 5% deposit?

Yes — many lenders offer 95% mortgages, though rates may be higher.

How long does approval take?

Mortgage offers are often issued within 2–4 weeks after application.

Do I need a mortgage broker?

You’re not required to — but a whole-of-market adviser can access more products than going direct to one bank.

At Trinity Financial, we:

-

Search across a wide panel of lenders

-

Provide personalised affordability advice

-

Support you from application to completion

-

Help with protection (life cover & income protection)

Buying your first home doesn’t need to be stressful — the right advice makes all the difference.

Ready to Take the First Step?

If you’re thinking about buying your first home in 2026, speak to a Trinity Financial mortgage adviser today. Your journey to homeownership starts with one conversation.

Call Trinity Financial on 020 7016 0790 to secure a fixed or tracker rate first-time buyer mortgage book a consultation, or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage