How much can I borrow?

If you're looking to borrow £400,000 over 30 years with an interest rate of 3.99%, that could cost you £1,907.36 per month on capital repayment or £1,330 on an interest-only mortgage.

Find out how much you can borrow with our mortgage calculator.

Try our Mortgage CalculatorUnlock Lower Monthly Payments with an Interest-Only Mortgage

At Trinity Financial, we specialise in helping homeowners, investors, and professionals secure the right interest-only mortgage for their financial goals. With expert advice, access to leading lenders, and a tailored approach, we make sure you fully understand the benefits and risks before committing.

What Is an Interest-Only Mortgage?

An interest-only mortgage allows you to pay just the interest on your loan each month, without repaying the capital during the term. This means your monthly repayments are significantly lower compared to a traditional repayment mortgage, but the loan balance remains the same until the end of the mortgage term.

Who Is an Interest-Only Mortgage Good For?

Interest-only mortgages can be suitable for:

-

Buy-to-let landlords looking to maximise cash flow and rental yields.

-

High-net-worth borrowers with substantial assets and investment strategies.

-

Homeowners with variable income such as business owners or contractors who want flexibility.

-

Borrowers with strong repayment plans from investments, savings, bonuses, or property sales.

Why Would You Choose an Interest-Only Mortgage?

Many clients choose interest-only mortgages because they:

-

Offer lower monthly payments, freeing up cash for other investments or expenses.

-

Provide flexibility for those with irregular income streams.

-

Can be part of a wider wealth management strategy if you have investments in place to repay the loan.

What Homeowners Need to Be Careful About

While interest-only mortgages can be an effective financial tool, they’re not right for everyone. It’s important to consider:

-

Repayment strategy – You must have a clear plan to repay the capital at the end of the term.

-

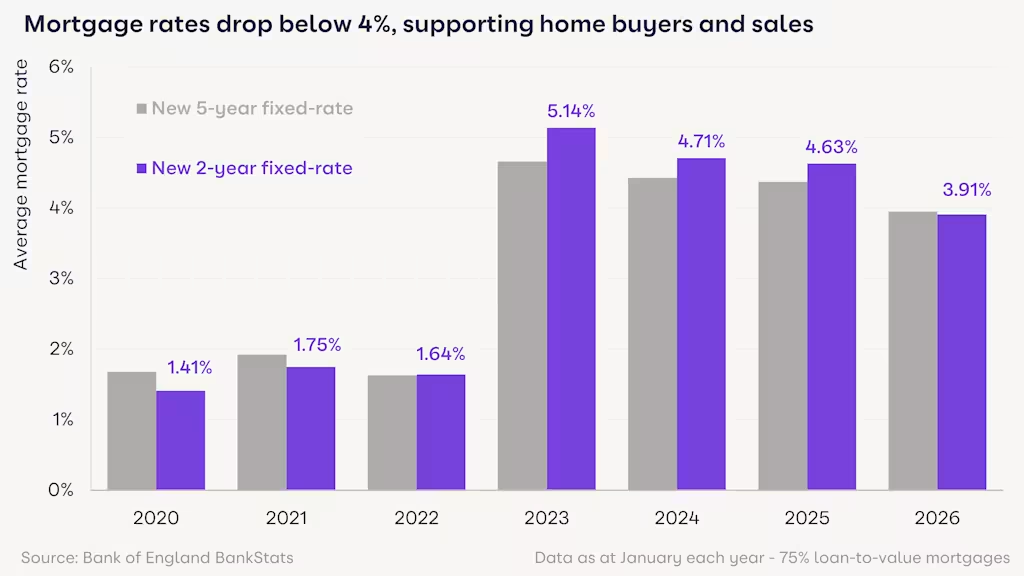

Rising interest rates – Your payments could increase if you are on a variable or tracker mortgage.

-

Affordability checks – Lenders will carefully assess your ability to repay at the end of the mortgage.

That’s why professional mortgage advice is essential.

Why Choose Trinity Financial?

-

Access to mainstream banks and private lenders.

-

Specialist knowledge of interest-only criteria and high-net-worth lending.

-

Tailored advice for both residential and buy-to-let mortgages.

-

FCA-regulated and trusted by thousands of UK homeowners.

Speak to an Interest-Only Mortgage Specialist

If you’re considering an interest-only mortgage, let our expert brokers guide you through the options. We’ll ensure you understand the benefits and risks, and help you secure the best deal for your circumstances.

Call Trinity Financial on 020 7016 0790 to secure an interest-only mortgage

Your home may be repossessed if you do not keep up repayments on your mortgage

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Talk to an Expert Mortgage Questionnaire

Aaron Strutt's Mortgage News

Aaron Strutt's Mortgage News