UK Finance predicting 10% increase in property purchase mortgage lending during 2025

UK Finance has published its housing and mortgage market forecasts for 2025. This year, it expects gradual mortgage affordability and market growth improvement, fueled by lower mortgage rates and cost pressures.

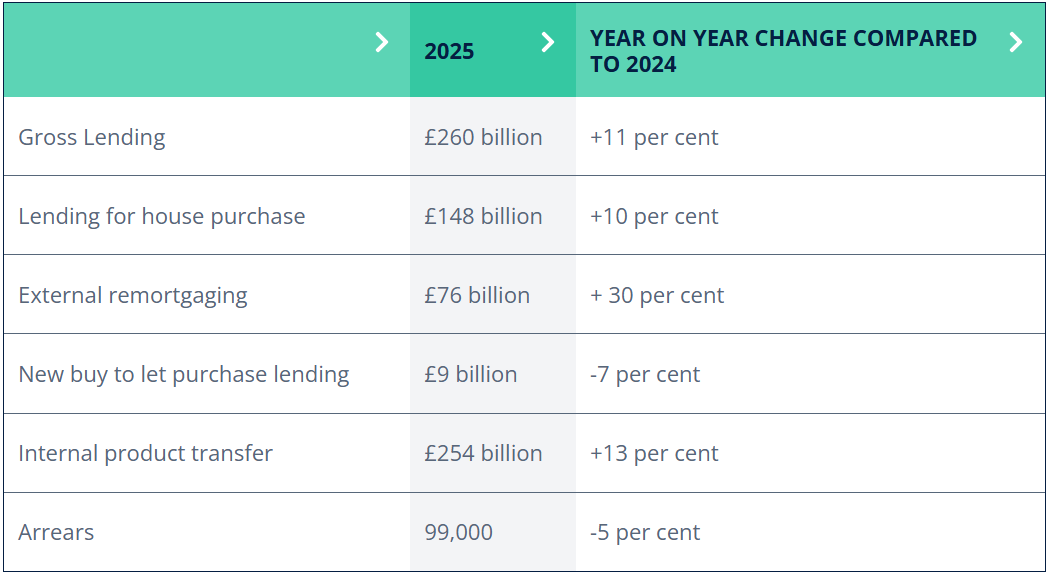

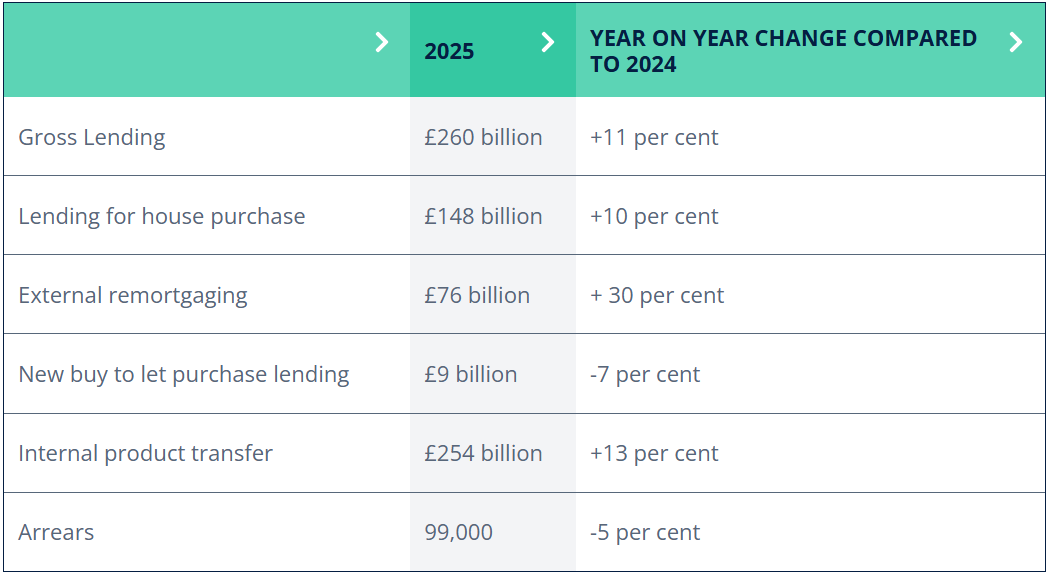

UK Finance, the trade body representing 300 financial firms, expects mortgage lending to homebuyers to rise by 10% on last year to £148 billion by the end of 2025. The trade body also predicts that the number of people remortgaging away from their existing bank or building society will increase by 30% to £76 billion.

Incredibly, the number of people sticking with their existing lenders when their mortgage rates end is due to rise by 13% to £254 billion, and buy-to-let mortgage lending is set to drop by 7% to £9 billion.

Upbeat forecast for 2025

UK Finance’s latest figures provide an upbeat forecast for 2025. Lower interest rates and easing cost of living pressures will increase mortgage affordability and buying activity.

The organisation says its predictions are based on a good 2024, which, although it saw activity well below previous years, 2025 should see considerable rises in mortgage lending as economic confidence returns.

Source: UK Finance

Anthony Emmerson, director of Trinity Financial, says: "We are optimistic about the upcoming year, especially as lenders are keen to issue more mortgages. However, there are things to be concerned about, particularly with Donald Trump becoming president again in a few weeks with potential trade tariffs and their effect on our inflation position here in the UK plus the ongoing wars.

“I still expect the Bank of England base rate to come down a few times this year and mortgage rates to edge down, boosting the property market and making mortgages more affordable. 2025, in particular, has a higher number of remortgages coming up for renewal, and the sooner borrowers can secure a rate, the better. We consistently swap our clients to cheaper rates when they come down, but the important thing is to get a deal agreed.”

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage