How to access your SA302's and Tax Year Overviews as income proof for your mortgage application

Banks and building societies expect to see evidence of your income when applying for a mortgage.

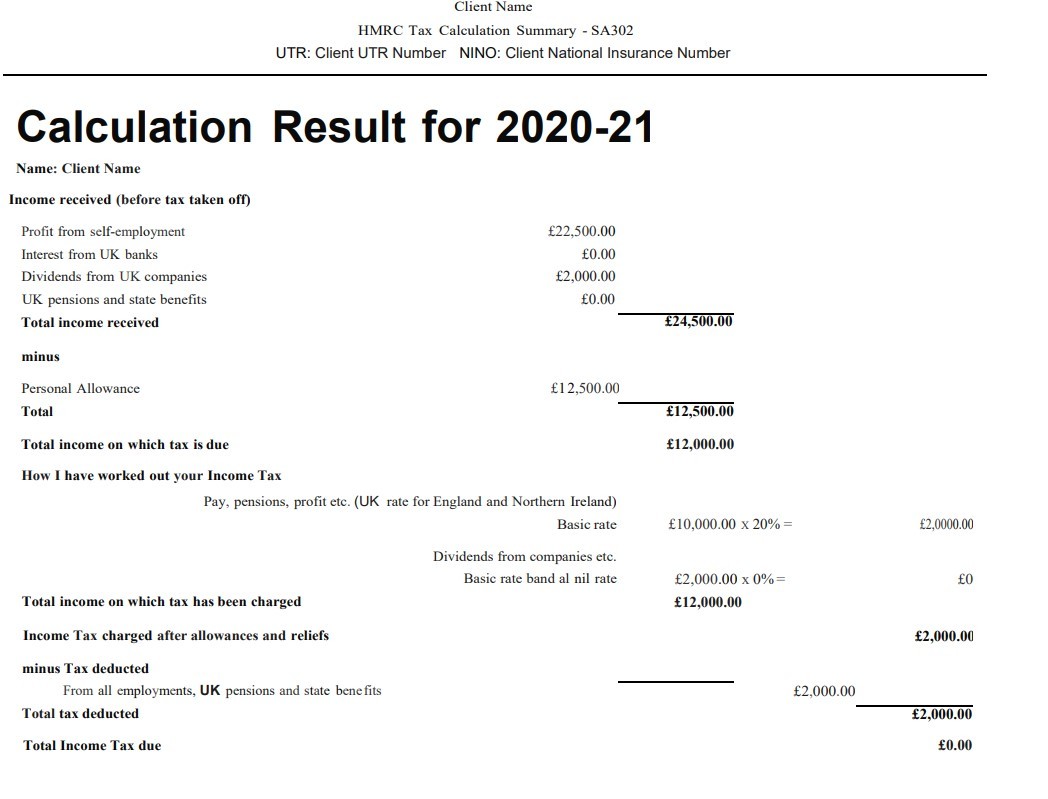

For the self-employed, this typically means producing your SA302 forms and the Tax Year Overviews.

Please note that Trinity Financial brokers will need your SA302 and Tax Year Overview to submit a mortgage application if you are self-employed.

How to print your SA302 form via the HMRC website

You will need access to your HMRC Online account to get these forms, or you may have to ask your accountant. You will also need your Government Gateway user ID and password.

If you are registered for Self-Assessment, select ‘Self-Assessment’.

- Log in with your user ID and password

- Follow the link to “Self Assessment.”

- Then "More details about your Self Assessment returns and payments”

- If you use an accountant, they may have to send over a copy. There should be a view and print option if you submit your accounts.

Example:  In addition to your SA302, you must provide Your Tax Year Overview.

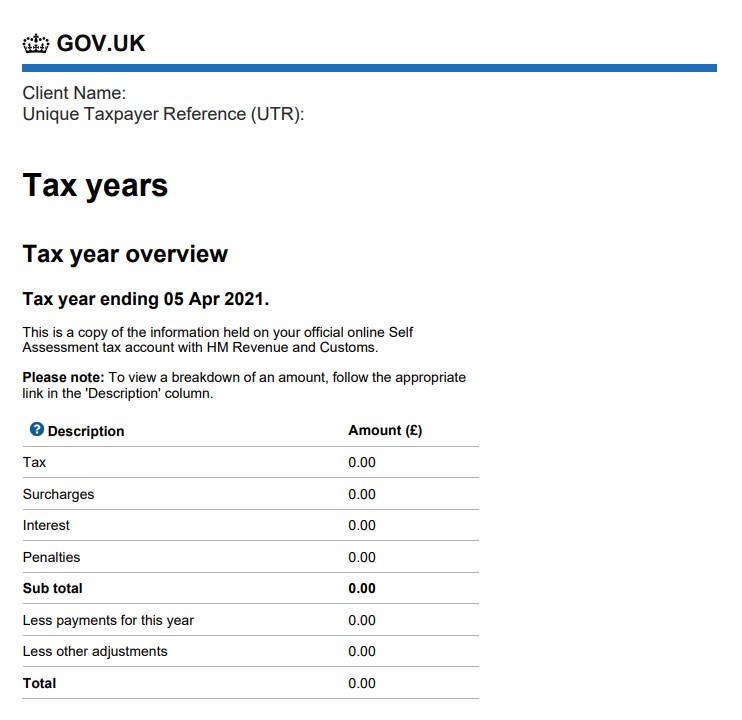

In addition to your SA302, you must provide Your Tax Year Overview.

To print your Tax Year Overview, follow these steps:

- Select ‘Self-Assessment’ (under 'Latest news and updates')

- Click on “View your payments.”

- Click “Tax years” on the drop-down menu on the right-hand side.

- Select the relevant Tax Year Ending and click “Go”

- Follow the link to “Print your tax year overview"

Example:

Call Trinity Financial on 020 7016 0790 to secure a self-employed borrower mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage