Record asking prices driven by pent-up demand: Rightmove

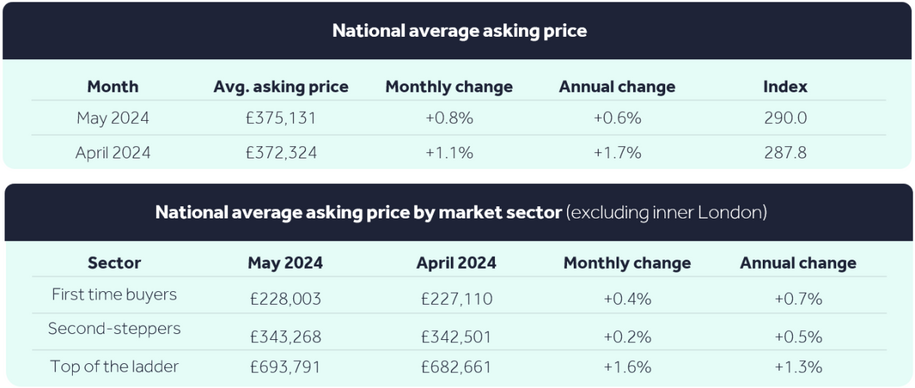

The average price of property coming to the market for sale has risen by 0.8% this month to a new record of £375,131, according to the latest Rightmove figures.

May is typically a strong month for price growth, with new price records set in May in 12 of the previous 22 years. Price growth is still led by the largest-homes, top-of-the-ladder sector, with prices in this sector up by an average of 1.3% compared with last year.

Since the previous price record set a year ago in May 2023, average prices are only 0.6% higher overall, a reminder that the market remains very price-sensitive.

Rightmove says pent-up demand from would-be buyers who paused their plans last year is a key driver behind increased home-mover activity despite mortgage rates remaining elevated for longer than anticipated.

Rightmove anticipates the number of completed sales transactions this year to reach around 1.1 million. It highlights that the number of sales agreed during the first four months of the year is 17% higher than last year, outstripping the 12% increase in the number of new sellers coming to market.

How long does it take to buy or sell a property?

Despite these positive lead indicators for higher transaction levels this year, Rightmove says it takes an average of 154 days between agreeing a sale and legal completion, and this remains a challenge for both agents and movers.

It adds that with an average of 62 days to find a buyer before the legal process even begins, would-be sellers hoping to be in a new home for Christmas need to take action now.

Rightmove’s analysis shows that properties that need an asking price reduction take more than three times longer to find a buyer than those that do not, giving sellers who price right from the outset the edge to sell more quickly.

Anthony Emmerson, director at Trinity Financial, says: "After the shock rise in rates it is good to see the market returning with more buyers entering the market now that rates have fallen from their highs after the mini budget of Liz Truss.

"Banks and building societies still want to lend, and although mortgage affordability has somewhat tightened due to the higher cost of living, the large rent rises for tenants are now causing mortgages to look more affordable for first-time buyers who have access to a deposit. Lenders have also done their best to support the higher loan-to-value product options to allow more first-time buyer rate options for clients.

"The lack of housing stock is still a concern as more people are having to compete over a limited supply of housing. This is true of the purchase market and the rental market at the moment."

Get a mortgage in principle agreed

If you plan to buy a property in the coming months, checking your credit report and getting an agreement in principle is a good idea. These agreements indicate whether you qualify for a mortgage, how much you can borrow, and the rate.

Trinity Financial's brokers are available to get agreements in principle agreed quickly and efficiently.

Source for article and graphic: Rightmove House Price Index

Call Trinity Financial on 020 7016 0790 to secure a mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage