New equity release borrowing hits record high in Q3: Equity Release Council

Image source: Equity Release Council

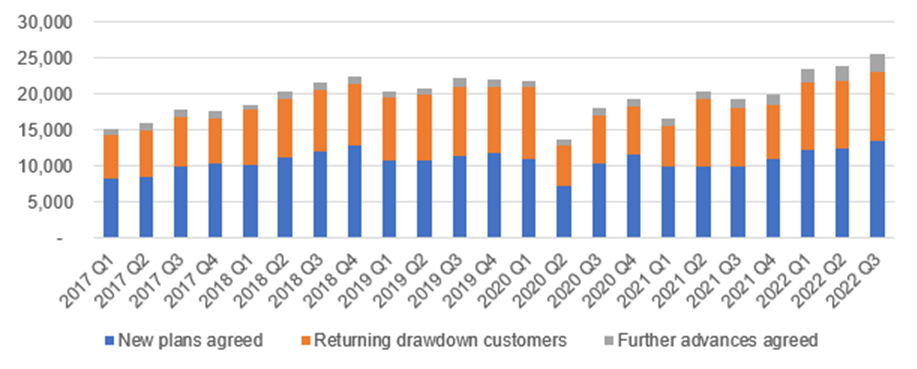

Homeowners aged 55+ took out a record 13,452 new equity release plans between July and September 2022 (Q3 2022), an 8% increase on the previous quarter. This is according to data from the Equity Release Council.

The amount of equity withdrawn from July to September reached £1.71bn for the first time. This continues the trend of quarterly increases during 2022, rising from £1.53bn in Q1 and £1.60bn in Q2 to reach £4.84bn for the first nine months of the year.

Comparing 2022 to date with the same period in 2021, when activity remained below pre-Covid levels, total customers served have grown 36% to 72,824 while total lending has risen 40%.

New customer numbers increased by a third (34%) year-on-year, with total lending to new and returning customers growing by 49%.

New plan sizes were largely stable at an average of £133,770 for lump sum lifetime mortgages, up 1% from Q2, while new drawdown plans dipped 3% to £88,340 for the initial withdrawal.

Activity reduced 10% in the final month of Q3 as September saw challenging economic conditions and product prices rise.

Jed Newton, director and equity release specialist at Trinty Financial, says: "To say that lifetime mortgage costs have increased dramatically over the last month would be an understatement.

"The critical thing that makes the impact of these higher lifetime mortgage rates so significant is the cost of servicing the interest. If it is rolled up, the compounding of interest will erode property equity more quickly. These figures are pretty eye-watering at the moment particularly compared to the cheap rates we have been used to. The borrowed amount will pretty much double in the 10th year and will reach three times the amount in the 15th year.

"Lifetime mortgages are being promoted as a solution to lack of income during the cost of living crisis, but with these interest rates, it is crucial that borrowers fully understand the impact of the rolled-up interest. These products may still be the only option or the most suitable route for some, but people need to go into these transactions with a full understanding of the implications of the current rates."

Call Trinity Financial's equity release specialist Jed Newton on 020 7016 0793 to secure finance

Equity release will reduce the value of your estate and may affect your entitlement to means-tested benefits and tax status.

Source: Equity Release Council data