How much can London's Square Mile workers borrow now the average salary has hit over £100,000?

Tags: Bonus income mortgages, Residential mortgages

Quick Summary

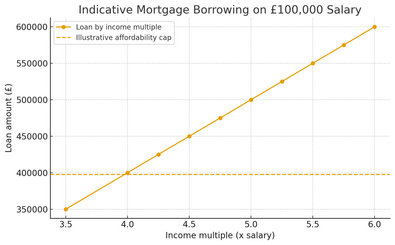

Average full-time pay in the City of London has reportedly broken through the £100,000 barrier for the first time following the return of banker bonuses. For an annual salary of £100,000, most mortgage lenders will typically offer between 4.0× and 5.5× your income, although some can lend 6× salary depending on your credit profile, existing commitments, and overall affordability.

Average full-time pay in the City of London has reportedly broken through the £100,000 barrier for the first time following the return of banker bonuses.

Latest official figures from the Office for National Statistics (ONS) and published in the Evening Standard show that full time workers in the Square Mile were paid an average of £103,352 in 2025, an inflation beating rise of 10.6% from last year’s figure of £93,438.

Pay in the City has been boosted in recent years by larger salaries for lawyers, particularly those working for US firms, the increasing number of tech firms clustering in the Square Mile, and resurgent bonuses for high-flying bankers and traders.

The Standard reports across London as a whole average full time pay rose 7.1% to £70,275, while median pay was up 4.7% at £49,692. If part time workers are included average pay rose 7.4% to £60,673, and median pay was up 3.9% at £43,190.

How much can I borrow for a mortgage on a £100,000 salary?

At Trinity Financial, we work closely with high-street banks and specialist lenders to help you secure the maximum possible mortgage based on your income and circumstances. We help Americans buying in the UK and professionals like bankers and traders receiving a large part of their income in bonuses.

For an annual salary of £100,000, most lenders will typically offer between 4.0× and 5.5× your income, although some can lend 6× salary depending on your credit profile, existing commitments, and overall affordability.

| Income Multiple | Estimated Loan Amount |

|---|---|

| 4.0× | £400,000 |

| 4.5× | £450,000 |

| 5.0× | £500,000 |

| 5.5× | £550,000 |

How Much of a Bonus Will Mortgage Lenders Take Into Consideration?

Each lender has its own policy on what proportion of your bonus can be included in affordability calculations. The key factors they look at are:

-

Frequency and consistency: Regular bonuses (monthly, quarterly, or annually) that have been paid for at least two years are more likely to be accepted.

-

Evidence: Lenders typically require payslips, P60s, or bank statements to confirm the bonus payments.

-

Guaranteed vs. discretionary: Guaranteed or contractual bonuses are treated more favourably than discretionary ones that vary year to year.

Typical Lender Treatment

| Type of Bonus | What Lenders Usually Consider | Notes |

|---|---|---|

| Guaranteed bonus | Up to 100% | If written into your employment contract |

| Regular annual or quarterly bonus | 50–100% (average over last 2–3 years) | Depends on consistency and employer |

| Irregular or discretionary bonus | 0–50% | Often only a portion is used to reflect variability |

As a rough guide, most high-street lenders will include 50% of your average bonus income from the past two or three years. Some specialist or private banks may consider up to 100%, especially for professionals in sectors like finance, law, or medicine. Banks and building societies have eased their bonus income policies in recent years.

Our advice for higher earners:

-

Applicants with minimal debt and strong credit can often achieve the higher multiples, and lenders will be so keen to issue mortgages that rates start from around 3.80%.

-

Joint applications clearly enable borrowers to access the most generous loan sizes, especially when both are working. The lenders' issue considers both salaries. Professionals on career progression schemes may access enhanced borrowing.

-

Trinity Financial’s advisers can compare multiple lenders to identify who will lend you the most based on your full financial situation and property requirements.

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage