First-Time Buyer Mortgage Guide: Step-by-Step to Getting on the Property Ladder

FIRST-TIME BUYER MORTGAGE GUIDE

Looking to buy your first home? Here’s everything you need to know — from saving a deposit to getting a mortgage offer accepted.

How does a lender classify a First-Time Buyer?

A first-time buyer is someone purchasing their first main residence and has never owned a property before. However, with some lenders, buyers cannot have owned a property within the last three years to be classed as a first-time buyer. If you’re unsure whether you qualify for a sufficiently large mortgage, contact us for a quick eligibility check.

Why does it matter if you're classified as a first-time buyer or not? Many of the lenders offer specific schemes and incentives. You may not qualify for them if you have previously owned a home.

Aaron Strutt, product director at Trinity Financial, says: "Buying a property does not need to be complicated, especially if you choose a good broker, an efficient and trustworthy solicitor, the estate agent is good, and the property chain is not too long or complicated. Getting good advice and choosing a good mortgage lender is important, as well as discussing your upcoming purchase with your close friends and family."

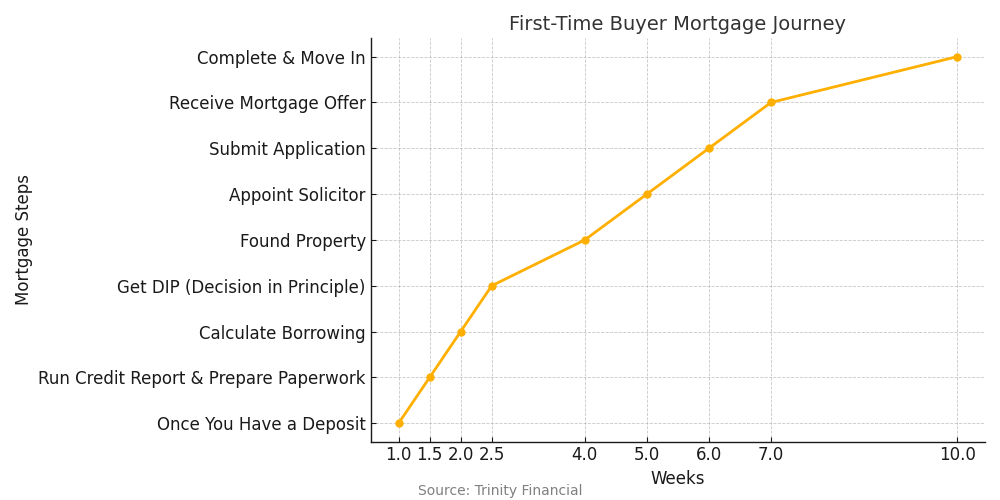

Step-by-Step mortgage journey for first-time buyers

Step 1: Save for a Deposit and keep tabs on your credit file

-

Minimum deposit required: 5% of the property value with most banks and building societies (e.g. £15,000 for a £300,000 home). Some lenders are offering 1% deposit mortgages, also 100% to longer-term renters.

-

10–20% deposits often unlock better mortgage rates.

- Making sure you know what your credit score is and that there are no errors on your credit report can save you a lot of time, money and hassle.

Step 2: Get a Decision in Principle (DIP)

-

A DIP is a conditional approval from a mortgage lender confirming how much you could borrow.

-

It strengthens your position when making offers, but it is not an offer. This is not a guarantee that the lender will lend you the money, but it is a good indication that it will provide a mortgage.

- Once you have a DIP, it is often not worth taking on new credit or buying things on finance if possible. Additional debt could reduce the amount you can borrow.

We can secure a DIP from multiple lenders in one go – without damaging your credit score. This is known as a soft footprint.

Step 3: Explore First-Time Buyer Schemes depending on the amount you need to borrow

Depending on your situation, you may qualify for:

-

The most popular first-time buyer scheme is arguably Nationwide's Helping Hand income stretch mortgage, which enables borrowers to access up to six times their annual salary to secure a mortgage.

- The Accord Mortgage £5k deposit scheme is a 1% deposit mortgage available to first-time buyers who provide a £5,000 deposit. The minimum loan size is £95,001, with a maximum of £495,000.

-

Skipton for Intermediaries is offering a 100% Track Record Mortgage, providing a no-deposit mortgage for current renters who haven't owned a property in the last three years and can demonstrate a track record of affordability of all monthly rent for a minimum of 12 months in the last 18-month period.

-

95% loan-to-value mortgages: Low-deposit mortgage lending is available through a range of banks and building societies.

We can explain which of these you’re eligible for and what lenders support them.

Step 4: Confirm How Much You Can Borrow

Lenders assess affordability based on:

-

Income (salary, bonuses, self-employment)

-

Monthly outgoings (credit cards, childcare, loans and cars on finance)

-

Credit history

Lenders use mortgage affordability calculators to determine how much you can borrow. Some lenders offer enhanced income multiples for first-time buyers, enabling them to borrow a higher amount of money.

Use our mortgage calculator to get a quick estimate. Or speak to a Trinity adviser, who will calculate your real borrowing potential and find a suitable lender.

Step 5: Find a property and get the offer accepted

- First-time buyers purchase all types of property, and they have a range of budgets. With many first-time buyers staying in their property for around five years before moving on, getting a spare room is a good idea if your budget stretches. This could give you the chance to let a room or even expand your family if you meet a partner.

- Try to obtain a property in a good location, with standard construction, and a straightforward legal pack. Freehold properties are becoming increasingly attractive due to the freedom from service charges and management agents.

- Once you have found a property, the lender will conduct a property valuation.

- Once your offer on a property is accepted, we'll help you submit the full mortgage application.

Step 6: Start the mortgage process

-

Once your offer on a property is accepted, we assist you in selecting a lender and completing the full mortgage application.

- You will need to decide if you want a two, three or five-year fixed-rate mortgage.

-

The lender will conduct a property valuation and issue a mortgage offer, it is typically valid for between 3–6 months.

- Before completing, check if the lender is offering a cheaper rate. If they are, switch deals.

- Appoint a trusted solicitor. Someone you can speak to and rely on. We have referred our clients to Steph Lyke for 20+ years.

Step 7: Complete and Move In

-

Exchange contracts and agree a completion date.

- The average time to complete a house or flat purchase in the UK typically ranges from three to six months. This timeline can vary significantly based on individual circumstances, such as whether you are part of a buying or selling chain, the complexity of the conveyancing process, and how quickly you secure a mortgage.

- Book a removal firm if you need one.

-

Get your keys and move in!

FAQs for First-Time Buyers

Do I need a mortgage broker?

Using a broker gives you access to exclusive deals, tailored advice, and faster approvals.

Can I buy with someone else?

Yes – joint mortgages are common. We can also help you understand options like Joint Borrower Sole Proprietor. Applicants can often borrow significantly more when they buy with someone else.

What if I have bad credit?

We work with lenders who understand real-life credit issues — we’ll help find the right fit.

Mortgage Consultation for First-Time Buyers

Whether you’re just starting or already house-hunting, our team of expert advisers can:

-

Compare mortgage deals from over 90 lenders

-

Help you plan your deposit strategy

-

Explain your scheme eligibility

-

Guide you from DIP to completion

Let’s turn your dream of homeownership into reality. Call Trinity Financial on 020 7016 0790 to secure a first-time buyer mortgage or a phone or video consultation.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage