More solo buyers getting mortgages with an increase in the number of women buying alone: Santander

Tags: First-time buyers, Remortgages, Residential mortgages

The number of first-time buyers buying solo is on the rise, driven by improved mortgage affordability rules, a major bank has said.

According to Santander UK figures, there was a 13.4% increase in sole borrower first-time buyer mortgage applications received between June and October compared to the prior period. More women are also buying homes on their own.

The growth for joint first-time buyers was around 13.1%, the first time that solo buyers have outstripped joint buyers in five years. The bank added that August saw the second-highest volume of individual applicants this year, at 53%, following its loan-to-income changes.

Santander's figures show that women made up around 48% of first-time individual buyers in 2025. This has been steadily growing since 2015, when the proportion of female first-time buyers came to 42%.

David Morris, head of homes at Santander UK, said: “We’ve seen a real shift in who’s driving the first-time buyer market. Where once joint applications dominated, more people are now stepping onto the ladder on their own.

“This year’s mortgage changes have helped to level the playing field for solo buyers, and the data shows that momentum has held firm. It’s clear that confidence among single buyers is growing as lending policy changes bring more of them closer to the homeownership dream.”

Single households also make up the largest household type in the social rented sector. Households containing one female (25%) and one male (22%) were most common.

What is the average age of a first-time buyer?

The average age of a first-time buyer in England has risen from 32 just before the pandemic to 34 now, the latest English Housing Survey reveals. In London, the average age of first-time buyers is even higher at 35.

Are there many first-time buyer low-deposit mortgages?

There is a wide range of five, ten, 15 and 20 per cent deposit mortgages available at the moment, along with a range of first-time buyer schemes. The lenders are very keen to issue more mortgages to younger people eager to get on the property ladder.

Here is a list of Trinity's top first-time buyer mortgage schemes, including Nationwide's Helping Hand product offering up to six times salary, NatWest's new scheme, plus other products enabling the Bank of Mum and Dad to help their adult children onto the property ladder.

More first-time buyers are taking 30-year mortgage terms

Some 62% of first-time buyers with a mortgage had a repayment term of 30 years or more in 2024/25, a notably higher proportion than five years ago, government figures showed.

Data from the Ministry of Housing, Communities and Local Government (MHCLG) in its English Housing Survey found that this was up from the 47% share of first-time buyers who had repayment terms of more than 30 years in 2019-20.

In 2024-25, 29% of new homeowners had a repayment period of 20-29 years, while 9% had terms of 1-19 years.

How much of a deposit do first-time buyers have?

The MHCLG data showed that 59% of first-time buyers paid a deposit of less than 20% of the purchase price of their home, and within this, 16% paid a deposit between 1% and 9% and 43% put down between 10% and 19%. Just 8% of first-time buyers bought their home outright in 2024-25.

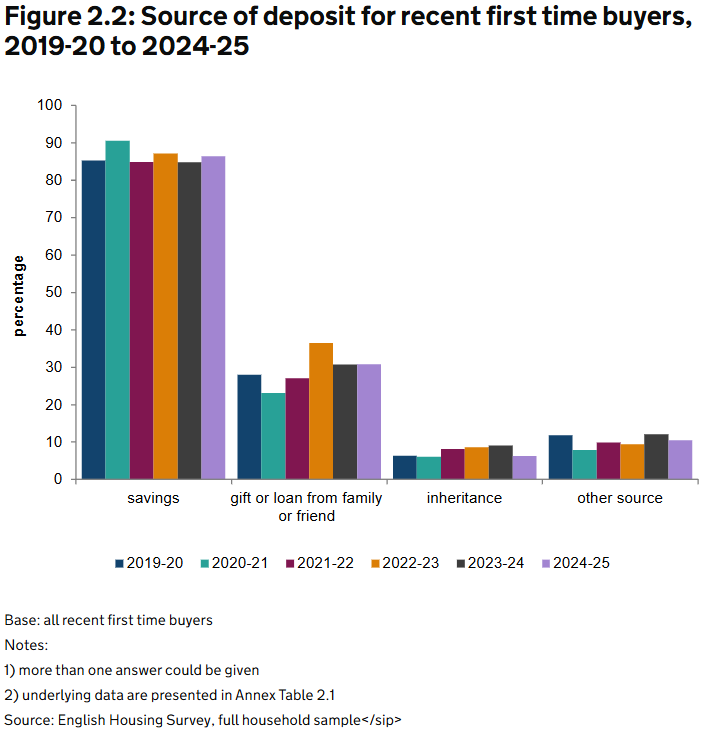

The majority – 86% – bought their first home using savings, while 31% said they were helped by family or friends. Some 6% of new homeowners used an inheritance for their deposit.

The average (mean) deposit of a first-time buyer in 2024-25 was £78,131 (£36,500 median). Given this, it was not surprising that the majority of first-time buyers were in the top two income quintiles.

Get expert mortgage advice from Trinity Financial

At Trinity Financial, our team of experienced London mortgage brokers specialises in helping borrowers secure the right deal. We work with all major lenders and can guide you through the full application process.

Call Trinity Financial on 020 7016 0790 to secure a first-time buyer mortgage or book a consultation

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage