BUDGET: Chancellor brings in mansion tax and higher landlord income tax

The 2025 Autumn Budget unveiled by the Chancellor will mean high-value homeowners and many landlords will end up paying more tax.

From April 2027, property-related income will face higher tax rates: 22% (basic), 42% (higher), and 47% (additional).

More landlords and buy-to-Let owners under pressure

The increased tax on property income comes after recent reforms that already reduced tax relief on mortgage interest for buy-to-let properties.

This tax will raise around £500million a year according to an accidentally-published document from the Office for Budget Responsibility this morning.

Hamptons head of research Aneisha Beveridge was quoted as saying: “Those operating through limited companies will remain unaffected, but for individual landlords who make up the bulk of the market and who are already squeezed by higher borrowing costs and previous tax changes, this could accelerate the trend of investors exiting the market."

New “Super Council Tax” for £2M+ homes

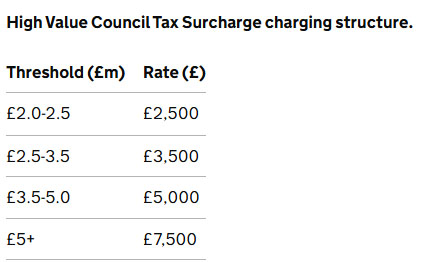

As part of the Budget, a new annual surcharge — dubbed the “mansion tax” — will apply from April 2028 to residential properties valued at over £2 million. This levy is intended to be an addition to the regular council tax and will be indexed to CPI inflation from 2029–30 onwards.

Estimates suggest the measure could raise roughly £400 million annually for the government.

There are currently about 145,000 UK homes valued at more than £2 million according to Savills but Knight Frank estimates that number will rise to 190,000 by 2028.

Potential Market Impact: Shift in Buyer Behaviour

Lots of landlords will be pretty cheesed off about having to pay more tax, but they have been expecting it for a while. This tax may well mean that even more previously rented properties are put on the market, which in turn pushes up rents in many areas. However, there may be more homes to buy for residential borrowers.

Buy-to-let mortgage rates have fallen significantly over the last year, and there are many cheap fixed-rate options. With more people paying higher taxes, lower mortgage rates will be even more important, so we can expect a Bank of England base rate cut in December. First-time buyers will still be keen to get on the property ladder, and more landlords will be looking to secure better rates or switch to limited company structures to be more tax efficient.

What else did the Chancellor announce?

- Income tax thresholds will be frozen until April 2031 meaning more people will pay higher rates as their pay increases.

- The two-child cap on means-tested benefits will be lifted.

- The government's tax take is likely to reach an all-time high of 38% of GDP in 2030-31.

- Cash ISA each year will be cut from £20,000 to £12,000 from April 2027 – though only if you're under 65.

Aaron Strutt, product director at Trinity Financial, says: "There was not much good news in this budget and the property sector may well get tougher for a while. The lenders are doing more so they can issue more mortgages, and borrowers can secure larger loans, but first-time buyers and buyers as a whole will want more from the Labour government.

"The much-hoped-for reduction or restructuring of stamp duty did not materialise, so this government will continue to receive billions in tax from the property sector, and buyers will continue to be put off or frustrated about how much they need to pay to buy or move home. It would have been nice to see something in the Budget to incentivise homeowners to rent out one of the millions of spare rooms or tempt older people to downsize. This seems like a missed opportunity to do more to improve the housing market."

Get expert mortgage advice from Trinity Financial

At Trinity Financial, our team of experienced London mortgage brokers specialises in helping borrowers secure the right deal. We work with all major lenders and can guide you through the whole application process.

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage