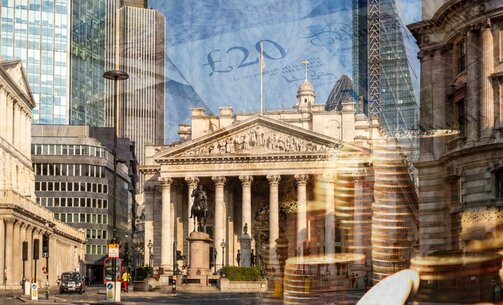

Bank of England base rate lowered to 4%

The Bank of England has cut interest rates to 4%, taking the base rate to the lowest level for more than two years.

According to the latest economic update from C. Hoare & Co initially the Bank of England Monetary Policy Committee voted in a three-way split: four members of the committee opted to cut base rate by 0.25%, one voted for a 0.50% cut, and another four preferred to leave the rate unchanged. This led Bank governor Andrew Bailey to call an unprecedented second ballot, resulting in a 5-4 vote to cut base rate from 4.25% to 4.00%.

There has been substantial disinflation over the past two and a half years, following previous external shocks, supported by the restrictive stance of monetary policy. That progress "has allowed for reductions in Bank Rate over the past year. The Committee remains focused on squeezing out any existing or emerging persistent inflationary pressures to return inflation sustainably to its 2% target in the medium term."

Markets are still pricing a longer-term base rate of 3.50%, equating to two further 0.25% drops, with the first cut now expected in February and another to follow by July 2026.

Lending solutions with Trinity Financial

Are you looking to buy a property or remortgage and need expert advice? We’re here to help you find a solution. Our specialist brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage