£147 billion worth of mortgages coming up for renewal over next six months

The remortgage market is set for a busy six months, with a huge number of homeowners needing to switch mortgage deals.

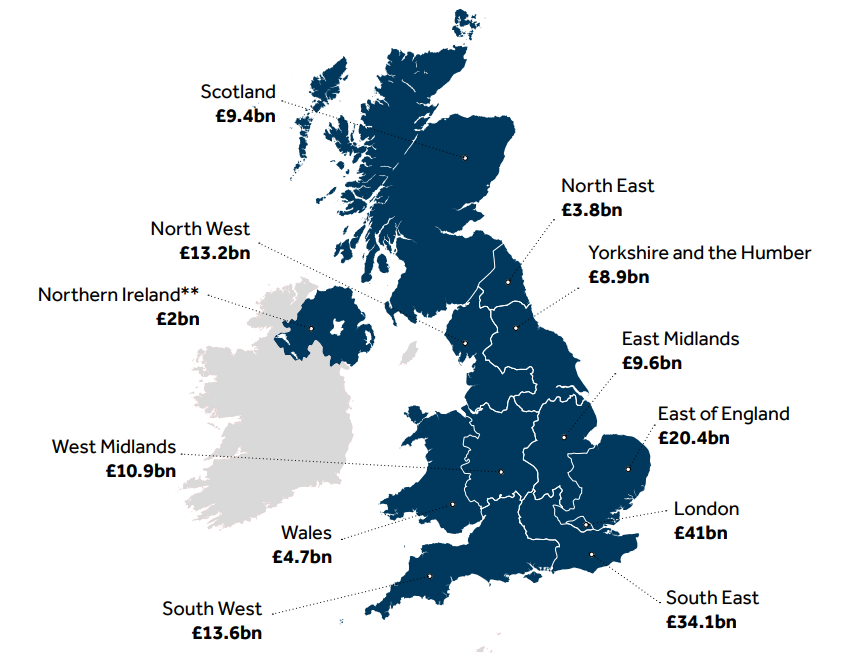

Market analysis from CACI* indicates that from July to December 2025, residential mortgages worth £147 billion – a 49.3% increase from 2024 – will reach the end of their term.

Many borrowers will be coming off cheap rates and switching onto mortgages priced between four and 5 per cent. Nationwide is one of a limited number of lenders still offering mortgage rates below 4%.

Aaron Strutt, product director at Trinity Financial, says: “If your mortgage is coming up for renewal soon, it is well worth checking what your lender is offering you to stay. If you send us an enquiry, we can help you secure a competitively priced rate and assess the market.

“UK Finance predicted at the start of this year that there would be a 30% rise in the number of homeowners remortgaging to a new lender rather than sticking with their existing provider. This is due to increased competition and more competitively priced rates, as well as people refinancing for home improvements or debt consolidation.

“Mortgage rates are cheaper than they were, and while many borrowers are still facing a repayment shock, it is not as big as some homeowners have faced. This clearly only provides a limited amount of comfort to those facing increased monthly costs.”

* CACI Ltd Mortgage Market Database as at February 2025. ** Maturity value for Northern Ireland (NI) likely to be higher as some NI only lenders are not included within the data. Data produced by Barclays.

What happens if you do not remortgage to a new deal?

When a fixed or tracker rate comes to an end, it typically reverts to the lender's standard variable rate, which is usually significantly higher than the mortgage pay rate.

In the past, research has shown that many homeowners do not act to switch deals until they see a significantly higher mortgage repayment leaving their bank account.

Should you opt for a two, three or five-year fix or even a tracker rate?

The period for which you want to lock in a rate depends on your attitude to risk and your longer-term view of the economy and mortgage rates.

Many borrowers are opting for two-year fixes, but three- and five-year fixes remain popular, especially among homeowners who believe that paying four per cent offers good value for money. Many borrowers opt for tracker rates primarily because they plan to sell their home and want a product with no early repayment charges.

Map of mortgages coming up for renewal in the UK

Here is a map of mortgages coming up for renewal provided by Barclay based on CACI Ltd Mortgage Market Database as at February 2025.

Call Trinity Financial on 020 7016 0790 to secure a remortgage rate, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage