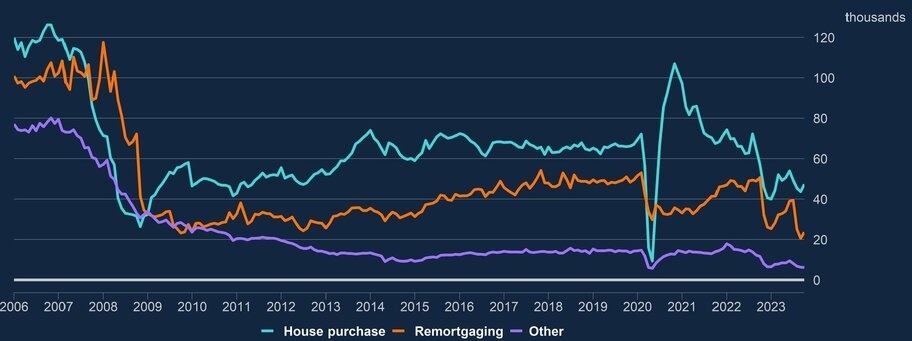

Mortgage approvals rise for first time since June as housing market stabilises

According to official Bank of England data, UK mortgage approvals rose in October—the rise in mortgages points to a stabilisation in the property market after prolonged low house sales.

The Bank of England said net mortgage approvals for house purchases rose to 47,400 in October from 43,700 in September. Net approvals for remortgaging increased from 20,600 in September to 23,700 in October.

Aaron Strutt, product director at Trinity Financial, says: “There seems to be more confidence in the property market now the Bank of England Monetary Policy Committee has held back from raising the base rate.

“Mortgage lenders have been offering cheaper rates, and there is more competition in the market to attract borrowers. Incredibly five-year fixes are roughly 0.75% below the base rate.”

The ‘effective’ interest rate – the actual interest paid – on newly drawn mortgages saw a 24 basis point increase and now sits at 5.25%.

Net borrowing of consumer credit by individuals amounted to £1.3 billion in October, down from £1.4 billion in the previous month.

Picture source: Bank of England

Call Trinity Financial on 020 7016 0790 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage