London-based mortgage brokers with expert knowledge & professional service

At Trinity Financial we provide a quick, consistent and quality fee-free service for MSE readers ensuring that we always find the best mortgage to suit you.

Residential Mortgages

Trinity Financial has a wealth of experience arranging finance for property purchases and remortgages. We have access to over 90 leading lenders, including banks and building societies, specialist lenders and the best private banks. We compare thousands of mortgage deals so you don’t have to.

Buy-to-let Mortgages

Trinity has access to lenders providing impressive rates and generous rental calculations, enabling them to offer more generous loan sizes.

We consistently arrange:

- First-time buyer mortgages.

- Residential remortgages and buy-to-let remortgages.

- Five times salary mortgages. Plus 5.5 times salary mortgages.

- Mortgages over £500,000 and £1,000,000.

- Fast mortgage offers.

- Interest-only mortgages.

- Mortgages for Professionals.

- Debt consolidation mortgages and capital raising.

- Second-home mortgages.

- Joint borrower sole proprietor mortgages.

- Investment banker mortgages and private bank mortgages.

- Longer mortgage terms.

Looking for a commercial mortgage, bridging or development finance? Visit our sister company Trinity Specialist Finance.

See our list of lenders.

How much can you borrow for a mortgage?

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Mortgage QuestionnaireFixed rate reductions continue as more sub-4% mortgage deals back on the market

4th Jul 2025 • By Aaron Strutt

It has been a week of rate reductions with more lenders reintroducing sub-4% deals to the market.

Prominent lenders that reduced fixed rates include Barclays, by up to 0.18%, Halifax by upto 0.10%, HSBC by up to 0.17%, NatWest by up to 0.15%, Gen H by up to 0.15%, Santander by up to 0.16% and finally, Virgin Money reduced its ‘intermediary exclusive’ rates by up to 0.05%.

Among the building societies to reduce rates were the West Brom Building Society by up to 0.28%, Leeds Building Society by up to 0.12%, Nationwide Building Society by up to 0.20% and Principality Building Society by up to 0.51%.

Aaron Strutt, product direcotro at Trinity Financial, says: "Our brokers have access to two-year fixes from just over 3.80% and five-year fixes available from just over 3.90%.

"There is a lot of compeition in the mortage market at the moment which is good news if you are planing to get on the property ladder or remortgage."

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

What does a good Mortgage Broker actually do?

28th Jun 2025 • By Aaron Strutt

Whether you're moving up the property ladder, downsizing, remortgaging your home, or buying your first property, working with a reputable mortgage broker can save you time, effort and money.

In some cases, using an award-winning mortgage broker, like Trinity Financial, can be the difference between getting a mortgage to buy the property you want or not.

But what is a mortgage broker, exactly? What services do mortgage brokers provide? In this article, we will address the most frequently asked questions about mortgage brokers.

-

What does a good mortgage broker do?

A mortgage broker acts as a middleman between you and the mortgage lenders. They:

- Provide a private and confidential service.

- Research the market to find the most suitable and cost-effective mortgage.

- Take the time to understand your personal and financial property-related needs and requirements.

- Apply to lenders on your behalf once you have provided them with permission, the necessary documentation and proof of identity.

- Work to secure the mortgage loan size their clients need at the lowest possible rate.

- Often get access to deals not widely available.

- Notify you if a cheaper mortgage rate than the one you have applied for with a lender is available.

- Contact business development managers to obtain approval for complex cases, even if the applicant does not meet the standard acceptance criteria.

-

Is it quicker to use a Mortgage Broker or apply to a lender directly?

In many cases, it is much quicker to get a mortgage through a broker.

Trinity Financial regularly submits mortgage applications for our clients before they have been able to get an appointment with their bank or building society's mortgage adviser.

It typically takes ten working days to produce a mortgage offer; however, if an application is straightforward, it may be possible to receive a mortgage offer within a few hours or a few days.

Brokers accounted for 87% of all mortgages written in the UK in 2024, and this figure is expected to rise according to the Intermediary Mortgage Lenders Association.

-

What documents will I typically need to provide to a mortgage broker?

To provide you with bespoke mortgage advice and submit an application to the recommended lender, your adviser will need you to complete and return a mortgage questionnaire and supply the following documents (for each applicant, as applicable). They will also want to have a 15-minute consultation.

At Trinity Financial, we will request proof of Identity, proof of address, and proof of income (three months' payslips if employed or the last two years' SA302 tax computations and tax year overviews if self-employed. Or a copy of your contract(s).

Additionally, provide three months' bank statements (full monthly statements showing salary credits, which can be online-generated), proof of deposit funds (if applicable for a purchase), details about your work plans, and your anticipated retirement age. Plus, a copy of your visa is required if you are a foreign national.

-

What are the advantages of using a mortgage broker? And the disadvantages?

Advantages of using a mortgage broker

- They could save you time and money.

- They possess the necessary expertise, systems and contacts to secure mortgages quickly and efficiently.

- It is convenient. You do not need to stay on hold to chase mortgage lenders. You also do not need to complain if something goes wrong with the application, because any decent broker will have access to the decision-makers at the banks and building societies.

- A reputable broker should be able to secure the lowest rates and the most generous loan sizes for you.

- A good broker will also work closely with your estate agent and solicitor to help ensure the property purchase is completed smoothly.

Disadvantages of using a mortgage broker

- There may be costs involved.

- Some brokers offer a limited number of mortgage deals.

- The quality of brokers varies.

-

Understand their access to lenders

Some brokers have access to a vast network of lenders, while others work with a smaller panel of lenders. You’ll want someone who can shop around for the best rates and terms, rather than just pushing one product.

Trinity Financial's brokers have access to a wide range of lenders, including large and small banks, building societies, and specialist and bespoke lenders. Plus private banks seeking high net worth clients.

-

Check their reviews and testimonials

- Look on Google or Trustpilot for reviews about their company. See if the firm has taken the time to respond to the reviews.

-

Evaluate their communication skills

Good brokers are:

- Transparent about costs and timelines.

- Easy to reach and responsive, ie they pick up the phone and reply to emails. At Trinity, each broker has a designated mortgage administrator that our clients have access to. They help keep clients updated at each important stage of the application process.

- Willing to explain terms and options in plain language.

- A good broker will inform you of the lender they recommend as part of their advice and recommendation process.

-

Watch for red flags with Mortgage Brokers

Avoid brokers who:

- Pressure you into quick decisions.

- Do not tell you the name of the lender they recommend.

- Are vague about fees or charge upfront fees.

- Promise unusually low interest rates without explanation.

- Force you to use them if you want to buy a property through the estate agent they are linked to.

-

What other services do they offer?

A mortgage broker's primary role is to secure a mortgage for their client, but financial protection policies are also crucial. At Trinity our specialists arrange:

- Financial protection policies, such as life insurance or critical illness cover. This is designed to help ensure borrowers can remain in their property in the event of death or illness.

- Building and contents insurance.

- Wills and Trusts.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Choice of buy-to-let mortgages rises to a record high

27th Jun 2025 • By Aaron Strutt

Fixed and tracker rate mortgage availability in the buy-to-let market has reached a record high, with the average two-year fixed rate having dropped below 5% for the first time since September 2022. This is according to the latest analysis by Moneyfactscompare.co.uk.

Overall buy-to-let product availability (fixed and variable rate) rose to 4,144 deals, its highest count on Moneyfacts records. Deeper analysis shows a larger quantity of five-year fixes versus two-year fixed deals.

Average buy-to-let fixed rates over two- or five-year fixed terms overall fell month-on-month, for the fourth consecutive month. The average two-year fixed rate is at its lowest point since September 2022, whereas the average five-year fixed rate is at its lowest point since October 2024.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk, said: “Landlords must ensure their property has a minimum Energy Performance Certificate (EPC) rating of C, by 2030 at the latest, according to the Government’s latest proposals. This is why a buy-to-let investment might not work for accidental landlords who are not able to fork out the costs to make renovations."

In addition to the potential changes landlords need to make to their properties to increase energy efficiency, there are also tax changes that have priced many landlords out of the market. Other landlords have been forced to sell up or take out a limited company buy-to-let mortgage.

Demand for property is not slowing down

Despite the challenges in the buy-to-let market, there remains a significant demand for property, which is unlikely to subside anytime soon. With England’s population projected to grow by more than 6 per cent over the next decade, according to the latest figures from the Office for National Statistics, more rental properties will be needed.

Call Trinity Financial on 0808 1642174 to secure a buy-to-let mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

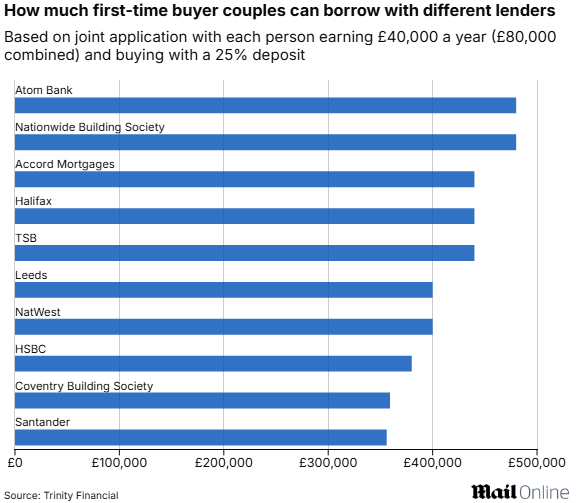

Trinity calculate figures for thisismoney.co.uk - How choosing the right mortgage lender could allow a first-time buyer to borrow £124,000 more

26th Jun 2025 • By Aaron Strutt

Trinity Financial calculates first-time buyer borrowing figures for thisismoney.co.uk

First-time buyers may be pushed into buying smaller, cheaper homes in less desirable areas if they pick the wrong mortgage lender, new analysis has revealed.

Mortgage broker Trinity Financial entered details of a fictional typical first-time-buyer couple into nine mortgage lenders' online calculators to find out how much they could borrow.

It found that mortgage lenders offer different loan amounts to applications with identical circumstances due to their varying mortgage affordability assessments.

Nationwide offers to lend up to six times annual income, via its Helping Hand scheme, which is available to eligible first time buyers with its five and 10 year fixed rate mortgages.

Securing a Helping Hand mortgage with Nationwide on a five-year fix with a 25 per cent deposit could mean a couple earning £40,000 each (£80,000 combined) could borrow up to £480,000.

Aaron Strutt of Trinity Financial, told thisismoney.co.uk: 'Many first-time buyers do not realise that the amount they can borrow ranges so significantly depending on the lender they apply to for a mortgage.

'It does pay to shop around when it comes to mortgage affordability and borrowing the amount you need. Most lenders use completely different calculations to determine how much their customers can borrow, and as a result, the maximum loan sizes can vary significantly.

'Lenders can also offer surprisingly large loans to joint applicants with clean credit histories and strong incomes.'

Click here to read the full story

Call Trinity Financial on 0808 1642174 to secure a mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Barclays undercut Nationwide and bring back two-year fixed mortgages starting from 3.88%

25th Jun 2025 • By Aaron Strutt

Barclays for Intermediaries has lowered a selection of its fixed-rate mortgages again and brought back two-year fixed rates priced from 3.88%.

The new mortgages will undercut Nationwide for Intermediaries' cheapest two-year fixes for property purchases. Nationwide offers fixed rates priced around 3.90% with £1,499 arrangement fees, and they are available to borrowers looking to raise between £300,000 and £5 million.

Barclays has a range of two, three and five-year fixed rates priced below 4% typically for mortgages up to £2 million. The 3.88% rate is fixed for two years, with a £899 fee, and applicants must have a 40% deposit to qualify. The equivalent five-year fix is 0.10% more expensive with Barclays.

Aaron Strutt, product director at Trinity Financial, says: “Swap rates are used as part of the process of funding mortgages, as they are edging down again after they went up a few weeks ago. This means we may well see more rate cuts from the lenders pretty soon.“

“If you have a 40% deposit and you want a cheap three-year fix, then MPowered has a sub-3.90% three-year fix. It has a £999 arrangement fee and a maximum loan size of £1.5 million.“

Halifax has lowered some fixed rates for property purchases by 0.07% and remortgage rates by up to 0.18%. TSB is also lowering rates by up to 0.15%.

Representative example: A capital and interest mortgage of £500,000 payable over 30 years, initially on a 3.88% fixed rate for 30 September 2027 and then on a variable rate of 6.24% for the remaining 27 years, would require 26 monthly repayments of £2,352.62 followed by 334 monthly repayments of £3,032.81. The total amount repayable would be £1,075,256.66 made up of the loan amount, plus interest (££574,125.33) and £899 (product fee), £80 (final repayment charge), £35 (completion fee). The overall cost for comparison is 6% APRC representative.

Call Trinity Financial on 0808 1642174 to secure a mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Nationwide eases policy to offer 5% deposit new build house mortgages at 6 times salary

24th Jun 2025 • By Aaron Strutt

- Nationwide to offer 5% deposit on new build house mortgages

- Nationwide offering up to 6 times’ income with a 5% deposit via Helping Hand scheme

- The deposit for new build flats to be lowered to 15% of the purchase price

- Mortgage offers on new builds will be extended to nine months

Nationwide for Intermediaries is lowering the deposit required to purchase a new build house on Thursday, 26th June, as it ramps up support for the housebuilders and the government’s housing ambitions.

First-time buyers will also be able to use Nationwide’s Helping Hand to make their new build house purchases up to the maximum loan-to-value. Nationwide is the largest mortgage provider to allow lending of up to six times income with a 5% deposit.

According to Nationwide, mortgage new build sales in 2024 were approximately one-third lower than in the last full year of the government’s Help to Buy scheme in 2022. Deposit requirements and affordability challenges have played a major part in this and Nationwide’s latest changes will support the new build sector by tackling them.

New build flats: Nationwide’s support extends to the entire new build sector because, at the same time, Nationwide will also be increasing the maximum loan-to-value available for applications involving new build flats to 85% loan-to-value.

New build offer periods: Nationwide will also be increasing its offer period for new build properties from six months to nine months. Although the vast majority of new build purchases complete within a six-month period, this change will give customers and brokers greater certainty and flexibility during the construction process. The longer offer period reduces the risk of needing to reapply for the mortgage in the event the property takes longer to complete.

Aaron Strutt, product director at Trinity Financial, says: "Many other lenders would not be comfortable offering a product like this, but from a borrower's perspective, it gives many people the chance to get on the property ladder and buy a new home."

England’s population is projected to grow by more than 6% over the next decade, with significant regional and demographic disparities that may reshape demand for housing and mortgage lending, according to the latest figures from the Office for National Statistics.

Call Trinity Financial on 0808 1642174 to secure a new build mortgage, book a consultation, or complete our mortgage questionnaire.

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

The i - Britain's biggest mortgage lender among four major banks cutting rates

1st Jul 2025 • By Aaron Strutt

Halifax is among multiple major mortgage lenders to cut rates on their home loans from Tuesday.

Britain’s biggest mortgage lenders have cut some rates by up to 0.1 percentage points. It is joined by Santander, HSBC and Barclays, which are all cutting rates this week.

Aaron Strutt, of Trinity Financial, told The i: “Competition between the big six lenders is intense so the longer they delay bringing down their rates the more business they will lose.

“Thankfully the cost of borrowing has been coming down again so they can lower their rates. Nationwide and Barclays have been offering many of the cheapest rates for a while and the other lenders are pushing to match them.”

Click here to view the fill story £

Thisismoney.co.uk - How choosing the right mortgage lender could allow a first-time buyer to borrow £124,000 more

26th Jun 2025 • By Aaron Strutt

First time buyers may be pushed into buying smaller, cheaper homes in less desirable areas if they pick the wrong mortgage lender, new analysis has revealed.

Mortgage broker Trinity Financial entered details of a fictional typical first-time-buyer couple into nine mortgage lenders' online calculators to find out how much they could borrow.

Aaron Strutt of Trinity Financial told Thisismoney.co.uk: 'Many first-time buyers do not realise that the amount they can borrow ranges so significantly depending on the lender they apply to for a mortgage.

'It does pay to shop around when it comes to mortgage affordability and borrowing the amount you need.

'Most lenders use completely different calculations to determine how much their customers can borrow, and as a result, the maximum loan sizes can vary significantly.

Click here to read the full story

Daily Mail - Nationwide changes mortgage rules to let first-time buyers buy new builds with just a 5% deposit

25th Jun 2025 • By Aaron Strutt

Nationwide Building Society is offering first-time buyers the chance to get a mortgage covering up to 95 per cent of the purchase price when buying new build houses.

The mutual says the mortgage product will be available from Thursday and will also enable buyers to borrow up to six times' their annual income, when they do so via its Helping Hand scheme.

Aaron Strutt of mortgage broker Trinity Financial, told Thisismoney.co.uk: 'A new build first-time buyer 5 per cent deposit mortgage at six times salary is pretty punchy.

'Many of the other lenders would not be comfortable offering a product like this. But from a borrower perspective, it gives many people the chance to get on the property ladder and buy a new home.'

Click here to read the full story

Mortgage Strategy - Nationwide trims prices by up to 12bps, rates start from 3.90%

4th Jun 2025 • By Aaron Strutt

Nationwide will reduce rates by up to 0.12% across selected two-, three- and five-year fixed rate products, with rates starting from 3.90%.

Effective tomorrow, reductions have also been made for remortgage customers. Rates for existing customers switching, which are not changing, already start from 3.84%.

Commenting on the cuts, Trinity Financial head of communications and PR Aaron Strutt says: “Good to see Nationwide lowering rates again after putting them up a few weeks ago especially as most lenders have been pushing up the cost of their mortgages.”

Click here to read the full story

Mortgage Strategy - Halifax and Principality lift mortgage rates by up to 0.14 per cent

21st May 2025 • By Aaron Strutt

Halifax will raise and cut selected fixed-rate mortgage rates by up to 14 basis points on Friday, while trimming others, as Principality Intermediaries also lifts rates.

The country’s largest mortgage lender will raise homemover and first-time buyer products by up to 10bps on some fixes, it said in a broker’s note without giving further details.

Trinity Financial product and communications director Aaron Strutt says: “It does seem like mortgage rates will be going up over the next few days and there may well be a lot of changes over the coming week or two.

“The sub-4% rates we have been used to seeing and borrowers like so much will almost certainly be pulled soon, given how much the cost of funding has increased.

“Borrowers in the process of buying a property or coming up to remortgage should try to secure one of the cheap fixes soon because the lenders do not tend to give much notice that they are pushing their prices up.”

Click here to read the full story

The Sun - HOUSE THAT All your mortgage questions answered including when is best time to buy and what type of deal you should get

17th May 2025 • By Aaron Strutt

Lenders have been slashing mortgage rates, bringing relief for millions of borrowers.

The Bank of England, led by Governor Andrew Bailey, has already made two cuts to its base rate this year and it is widely expected that more will follow.

House prices are expected to rise by between one and four per cent this year, according to forecasts.

But experts warn it’s not worth obsessing with short-term movements in prices when buying a home you plan to live in for years.

Aaron Strutt, of broker Trinity Financial, told The Sun: “It is hard to guess the mortgage and property markets, so if you find a nice property and affordable mortgage, it is probably a good time to get on the housing ladder.”

Click here to read the full story - subscription required

£1.5 million mortgage for solicitors buying family home

4th Jul 2025 • By Aaron Strutt

Trinity Financial recently helped two solicitors buy their first family home after they found our contact details online.

They had an offer accepted and wanted advice on the most competitively priced rates for higher-earning individuals requiring larger mortgage loans.

Did they have a complex situation?

Our clients were both employed solicitors with high salaries, and they had a £300,000 deposit. This meant they were well within affordability and would qualify with multiple lenders.

Trinity’s broker researched the rates being offered across the £1 million+ market and found a large bank offering a competitively priced two-year fixed rate. This lender is very keen to attract wealthy borrowers and it has a range of larger loan rates.

Our broker submitted their mortgage application once they had received their client's documents and confirmation to proceed. The lender's large loan team swiftly accepted it and was happy to offer the mortgage.

Was the rate particularly good?

Mortgage rates were higher than they are currently, and they have been trending downward. We initially locked in a rate just above 4.6% fixed for two years, and switched the mortgage offer twice, bringing the rate down to below 4.25% a few days before they needed to exchange contracts and complete their purchase.

How long did it take to produce the mortgage offer?

The initial mortgage was offered within three working days. The lender has a specialist team to assess and provide mortgages for £1 million or more.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£1.2m interest-only product transfer rate switch for city trader

1st Jul 2025 • By Aaron Strutt

Trinity Financial recently arranged a £1.2 million product transfer for an existing client nearing the end of his fixed-rate.

Working as a city trader a large part of his income is paid in bonuses and he wanted to get a competitively priced two-year fix but remain on interest only.

Did they have a complex situation?

Our client had a large salary, and mortgage affordability was not an issue; however, he had £1.2 million on interest-only, which put him at a 75% loan-to-value ratio. This meant he did not have many competitively priced remortgage options available to him.

He was not planning to move home and had been making lump-sum overpayments to bring down the mortgage balance.

Was the rate particularly good?

He was offered a two-year fixed rate at just over 3.90% with his bank to stick with them and this was a better deal than the one he had before. He opted for the two-year fix because he believed rates would be lower in the near term.

Trinity's broker researched the market and was unable to find a suitable mortgage that offered a more competitive price. He submitted the mortgage rate transfer application when the client confirmed he was happy to proceed.

How long did it take to produce the mortgage offer?

A product transfer mortgage offer is typically issued on the same day as the application is submitted via brokers like Trinity Financial.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£850,000 mortgage for clients keeping old home to give them time to refurbish new property

1st Jul 2025 • By Aaron Strutt

Trinity Financial recently secured a £850,000 mortgage for a professional couple purchasing a £1 million property in London.

They already had a mortgaged property they lived in and wanted to keep it before putting it on the market to avoid having a chain and potentially delaying completion. They also wanted time to refurbish their new home.

Did they have a complex situation?

Our clients are higher earners and had a 15% deposit. However, not all lenders are comfortable with borrowers technically having two residential properties, even if it is for a short period.

After researching the market, Trinity's broker found a large high-street bank willing to offer the full £850,000, allowing our clients to have two residential mortgages. The lender offered competitively priced rates and has swift turnaround times.

To meet affordability requirements, applicants must demonstrate that they can afford two mortgages simultaneously, even with lenders' higher stress test rates.

Was the rate particularly good?

The lender offered a two-year fixed rate priced around 4.25%, and the clients opted for a 35-year term to lower their monthly repayments. The lender allowed 10% of the mortgage to be repaid each year without charge.

How long did it take to produce the mortgage offer?

The mortgage offer was produced within a week of the application being submitted.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances.

At Trinity Financial, our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£400,000 mortgage for junior doctor based in the Isle of Man buying in London

22nd Jun 2025 • By Aaron Strutt

Trinity Financial recently helped a couple buying their first home to secure a £400,000 mortgage to purchase a £500,000 flat in London.

Did they have a complex situation?

One of our clients is a junior doctor based in a hospital on the Isle of Man, and his partner, who works in London, was on a visa.

When he finished his training on the Isle of Man, he planned to move in with his partner in London. But for the time being, he would return home and stay in the flat every month.

His partner was not British and was in the country on a visa without indefinite leave to remain.

This application was more complex because the Isle of Man is not part of the UK, and that's an issue for most lenders. Another broker said they could not do the deal because it was not possible!

Trinity's broker approached a host of lenders, and most of them would not provide a mortgage. He did find one bank happy with the fact that the client was a doctor and that he would be coming to stay in the property on a regular basis.

Was the rate particularly good?

Two-year fixed rate just below 4.10%. The couple thought interest rates would come down over the medium term and did not want to lock into a five-year fixed rate.

How long did it take to produce the mortgage offer?

It took two weeks to produce the mortgage offer once the application was submitted.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances.

At Trinity Financial, our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£500,000 building society mortgage using pending income from SIPP, pension, plus stocks and shares

15th Jun 2025 • By Aaron Strutt

Trinity Financial recently secured a £500,000 mortgage for a client with substantial funds in his Self-Invested Personal Pension (SIPP), pension, and stocks and shares.

He had found a £1 million house to buy in Surrey, and his offer was accepted, but he was struggling to find a lender willing to issue him with a mortgage.

Did they have a complex situation?

Our client has over £1 million in his SIPP, over £1.3 million in stocks and shares, and another substantial pension fund. However, as he was 55 years old, many lenders stated that he was not old enough to access the funds and he would have to wait.

Trinity Financial's broker contacted a range of lenders, and none of them were willing to lend him any money. This led her to speak to the specialist building societies and to contact their relationship managers.

After speaking to one provider with a reputation for lending to wealthier clients who do not meet all the criteria, a specialist mortgage underwriter assessed his financial situation and agreed to provide the mortgage.

They saw that the client had a good financial situation, a good credit score and determined that lending to someone with a large deposit and substantial income was a safe bet.

Was the rate particularly good?

The lender offered a reasonably competitive five-year fixed rate priced at just over 5% over a ten-year term. He planned to repay the mortgage quickly.

How long did it take to produce the mortgage offer?

The mortgage offer was produced quickly, and within a week of the application being submitted. The process was fast because we had all the documentation the lender requested, and the property valuation was satisfactory.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances.

At Trinity Financial, our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£700,000 mortgage on super cheap rate ported to new home with £250,000 top up

10th Jun 2025 • By Aaron Strutt

What did they do for a living? One of our clients is an IT Director, and his partner is a homemaker.

They had found a new home to buy and had their offer accepted. They wanted to take their existing £700,000 mortgage with them, using the porting facility, and borrow an additional £250,000.

Why did they need your help? They were existing clients and our broker arranged the original mortgage for them. They wanted help with the porting process, application and advice on the rate for the top-up loan part.

Did you struggle to find a lender? No, as porting made more sense. They had such a cheap rate that it would have been a real shame not to take it with them to their new home.

Was the rate particularly good? Ported £700,000 existing rate that was below 1% fixed until 30/11/26 and additional borrowing of £250,000 on a sub-3.90% two-year fix.

How long did it take to produce a mortgage offer? It took just over two weeks for the mortgage to be offered by their existing lender.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Get in touch

To arrange a meeting with one of our expert mortgage advisers complete our enquiry form or mortgage questionnaire and we will call you back. Please note, by submitting this information you have given your agreement to receive verbal contact from us to discuss your mortgage requirements.

You voluntarily choose to provide personal details to us when submitting an enquiry. Your information is confidential and held in accordance with the appropriate data protection requirements. Read Trinity Financial's privacy policy.