London-based mortgage brokers with a track record of providing expert mortgage advice

At Trinity Financial we provide a quick, consistent and quality fee-free service for MSE readers ensuring that we always find the best mortgage to suit you.

Residential mortgages

Trinity Financial has a wealth of experience arranging finance for property purchases and remortgages. We have access to 90+ leading lenders, including banks and building societies, specialist providers and the best private banks.

Industry figures released this month (February 2026) show the total number of mortgages on the market has risen above 7,500, meaning there are over 1,000 more deals to consider than a year ago. Trinity's brokers will help you select the right mortgage over the telephone, via video call, or in person at a convenient time for you.

Buy-to-let mortgages

Trinity's brokers have access to lenders offering impressive rates and flexible rental calculations, enabling them to offer more generous loan sizes.

We consistently arrange:

- Best buy mortgages!

- First-time buyer mortgages.

- Residential purchases and remortgages.

- Buy-to-let purchases and remortgages.

- Five times and 5.5 times salary mortgages, even six times and 6.5 times salary mortgages.

- Mortgages over £500,000 and £1,000,000.

- Fast mortgage offers.

- Low deposit mortgages.

- Interest-only mortgages.

- Mortgages for Professionals.

- Debt consolidation mortgages and capital raising for home improvements.

- Let-to-buy mortgages.

- Second-home mortgages.

- Joint borrower sole proprietor mortgages.

- Investment banker mortgages and private bank mortgages.

- Longer mortgage terms to help lower monthly costs.

- Mortgages without early repayment charges.

Looking for a commercial mortgage, bridging or development finance? Visit our sister company Trinity Specialist Finance.

We have access to 90+ leading lenders, including banks and building societies, specialist providers and the best private banks.

See our list of lenders.

How much can you borrow for a mortgage?

Get started with us today

Speak to one of our mortgage experts. Either book an appointment to come and see us, or request one of our experts to call you.

Book a Consultation Mortgage QuestionnaireCoventry, HSBC, NatWest and Nationwide announce fixed rate mortgage price increases

6th Mar 2026 • By Aaron Strutt

Nationwide, Coventry Building Society, Virgin Money, NatWest and HSBC are the first major lenders to announce rate increases.

HSBC and Coventry are the first major lenders to announce rate hikes due to increases in funding costs stemming from the chaos in the Middle East. It seems almost certain we are going to see a lot more rate changes over the coming days, so if you are on the hunt for a mortgage, it is worth locking into a new deal now.

There is a huge number of remortgages due this year, and most borrowers can switch rates up to four months before their fixed rates expire. Delaying a decision to select a new deal could be costly, especially if you have a larger mortgage loan.

NatWest has increased many of its two-year rates by 0.10% and its five-year fixes by 0.05%. Virgin Money has announced it is putting many of its rates up, and its two-year fixes will be increased by up to 0.25%, so they now start from 3.92%. Skipton is increasing its rates by up to 0.16% across its 2-year fixed-rate mortgage ranges for new business and existing customers.

How much are mortgage rates now?

The very cheapest two-year fixes start from just below 3.75%, while five-year fixes are available from 3.85%. However, they may be withdrawn at short notice.

These are typically offered through larger lenders like Barclays, Halifax, NatWest, and HSBC for Intermediaries.

Barclays and Santander offer a selection of the most competitively priced two-, three-, and five-year fixes. Nationwide offers lower rates to homebuyers taking out a mortgage of over £300,000. The building society is also taking an average of seven days to produce mortgage offers.

Should borrowers be thinking about fixing their mortgage more urgently right now?

Aaron Strutt, product director at Trinity Financial, says: "Yes. There are a large number of remortgages this year, and most borrowers can switch rates up to four months before their fixed rates expire. Rates are being pulled without much notice, which means even if you put off sorting your mortgage out for a few hours, you could end up paying more for years. This is no exaggeration."

Speak to a Trinity Financial adviser today

The mortgage market moves fast — and the right advice can make a significant difference to the rate and deal you secure. Get in touch with our team to discuss your options.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage, book a consultation, or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Two-year fixed rates still available below 3.55% - but how is the war going to affect mortgage rates?

4th Mar 2026 • By Aaron Strutt

Banks and building societies are set to increase their most competitively priced mortgage rates again, following the war in Iran and the escalation of conflicts across the Middle East.

Funding costs in the money markets have risen and some lenders have already said this will have a knock-on effect on UK mortgage rates.

Pete Dockar, chief commercial officer of mortgage lender Gen H, was quoted as saying: “The war in Iran is creating uncertainty in global markets and as a result, swap rates have shot up overnight. Specifically, the hampered distribution of oil through the Strait of Hormuz is already having an effect on global financial markets, and swap rates are no exception.”

Mortgage lenders typically price fixed-rate mortgages using SWAP rates. Santander recently made some large price improvements, especially to its low deposit mortgages, but it also made some small rate rises. It will be interesting to see what happens to mortgage rates over the next few days and weeks, especially if the situation in the Middle East does not de-escalate.

Is it worth securing a mortgage rate now?

Yes. If you are applying for a mortgage or holding off on securing a rate, it makes sense to lock in now. You can monitor the market and try to swap to cheaper deals if they are available before you complete your purchase or remortgage. At the moment, there have not been large-scale rate rises. Click here for rate updates.

How much are mortgage rates now?

Two-year fixes start from just above 3.5%, while five-year fixes are available from 3.80%. These are typically offered through larger lenders like Barclays, Halifax, NatWest, and HSBC for Intermediaries.

Mr Dockar added, “This is a bit of a blow to the mortgage market because, for the first time in recent memory, buyers were feeling really optimistic; steady house prices and lower rates were driving healthy demand. But if there’s anything we’ve had to get used to in the last few years, it’s this kind of volatility. So as ever, I return to the one piece of consumer advice that never changes: talk to your broker and lock in a rate if it’s right for you.”

Speak to a Trinity Financial adviser today

The mortgage market moves fast — and the right advice can make a significant difference to the rate and deal you secure. Get in touch with our team to discuss your options.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage, book a consultation, or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

NatWest bring rates down again with two-year fixes from 3.62% for mortgages up to £2 million

24th Feb 2026 • By Aaron Strutt

NatWest has implemented a broad set of rate reductions across its mortgage product range for new business, existing customers and additional borrowing. The changes span purchase mortgages, remortgages, first-time buyer deals, and buy-to-let products, with many fixed-rate options seeing cuts to their interest rates.

For two-year fixed purchase deals, reductions reached up to 0.19% and other loan-to-value tiers saw cuts ranging from about 8 to 20 bps, depending on product fee and deposit size. Five-year fixed purchase products also saw modest reductions, typically between 1 and 11 bps across various LTV levels. In the remortgage segment, two-year fixes were lowered by up to 15 bps at some LTVs, while five-year fixes saw reductions as well.

Aaron Strutt, product director at Trinity Financial, says: “NatWest is bringing down the cost of its fixed rates for borrowers with a range of deposit sizes. The bank’s cheapest two-year fix will be just over 3.60% and its best five-year fix will be below 3.85%. More lenders are improving their pricing again, and there are not so many rate hikes at the moment. Mortgage rates are a bit more expensive than they were but not much.

"The next MPC meeting is on the 19th March, and with the money markets predicting a 70% probability of a base rate cut, we may well see a few more price reductions soon. More of the lenders are telling us they are busy with new enquiries, particularly from first-time buyers and those remortgaging, especially with around 1 million homeowners coming off of cheap five-year fixed rates this year.”

Does NatWest offer generous mortgage income multiples?

NatWest recently changed its residential Loan-to-Income (LTI) calculations, enabling many homebuyers and remortgaging customers to access larger mortgage loan sizes. The bank consistently offers many of the cheapest fixed- and tracker-rate mortgages available in the market.

Anyone applying for a NatWest mortgage earning over £75,000 or £100,000 jointly will now be able to access up to 6.0x income, up from 5.5x, provided they have a deposit of at least 25% and they have a good credit score. For single or joint applicants earning over £40,000, the income multiple is also being raised to 5.5x times salary from 5.0x again when they have a deposit of at least 25%. These changes only apply to capital and interest mortgages, although higher-income multiple interest-only mortgages are available to borrowers with a clear interest-only repayment strategy.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage, book a consultation or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Lowest mortgage rates in four years supporting sales and surge in property listings: Zoopla

20th Feb 2026 • By Aaron Strutt

Key takeaways from Zoopla data

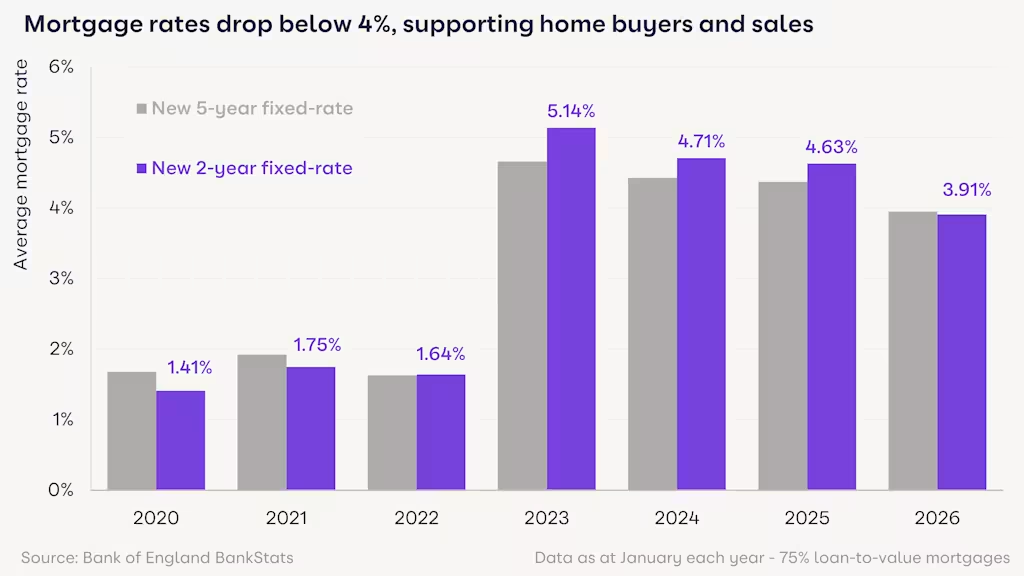

- Strong property sale numbers are supported by average mortgage rates dropping below 4%.

- 40% of homes for sale are now cheaper to buy with a mortgage than rent.

- Sales activity is healthy, but house price inflation remains subdued at 1.3%.

- House price rises are higher than last year in northern England and Scotland.

- Price falls have moderated in southern England.

What's happening in the housing market right now?

The housing market has started 2026 in notably better shape than many expected. Falling mortgage rates, improved lending conditions, and a surge in new properties coming to market are all creating a more positive environment for buyers and movers alike.

One clear trend in February 2026 Zoopla reports is a surge in the number of sellers bringing their homes to the market. February is on track to record the highest monthly number of new listings in a decade, reflecting improving seller confidence and a strong desire to move home.

There are already 6% more homes for sale than a year ago, and this is expected to rise further in the coming months. This increased supply boosts buyers' choice and will keep house price growth in check over 2026.

Mortgage rates are at their lowest level in four years

The big headline for buyers is that average mortgage rates on both 2-year and 5-year fixed deals have dropped below 4% for the first time since 2022. This is the result of falling base rates and strong competition between lenders — and it's translating directly into improved affordability.

At Trinity Financial, we're seeing lenders ease their affordability stress-testing too. Many are now assessing borrowers against a 6.5% stress rate, down from 8.5% a year ago. In practical terms, this means more people can borrow more — often up to six times single or joint salaries — and that's particularly good news for first-time buyers.

NatWest has just brought down the cost of its fixed rates for borrowers with a range of deposit sizes. The bank’s cheapest two-year fix will be just over 3.60%, and its best five-year fix will be below 3.85%. More lenders are improving their pricing again, and there aren't many rate hikes at the moment. Click here to view our larger mortgage loan best buy table.

40% of homes are now cheaper to buy than to rent

One of the most striking findings from the latest data is that 40% of homes currently for sale in the UK are now cheaper to buy with a mortgage than to rent locally. A year ago, with stricter affordability tests, that figure was just 25%.

House prices remain stable — and that's good news

Annual UK house price growth currently sits at 1.3%, with the average UK home valued at £269,900. Growth is strongest in the North West, Scotland, the North East and Northern Ireland, where affordability is better and stock remains tighter.

In southern England, prices are broadly flat over the past 12 months — an improvement on the modest falls seen in the second half of 2025. Buyers in these areas have more choice and more negotiating room than they've had in some time.

A surge in new listings is boosting buyer choice

February 2026 is on track to record the highest number of new property listings in a decade. There are already 6% more homes for sale compared to a year ago, and that figure is expected to rise further through spring.

More supply means more choice — and for buyers, it also means sellers need to price competitively to secure a sale. If you're buying in 2026, particularly in southern England, you may well find sellers open to negotiation.

What does this mean for you?

Whether you're a first-time buyer, a home mover, or looking to remortgage, the current market presents some genuine opportunities:

- Mortgage rates are the most competitive they've been since 2022, starting at 3.6%.

- Lenders are stress-testing at lower rates, so they are issuing more 5-, 5.5-, and 6-times-salary mortgages.

- There are more properties to choose from than at any point in the past decade.

- House price growth is modest and steady, reducing the risk of overpaying.

The Trinity Financial team works with a wide range of lenders, including many that offer exclusive rates not available to the public. We can help you understand exactly how much you could borrow, which deals suit your situation, and how to move quickly when you find the right property.

Speak to a Trinity Financial adviser today

The mortgage market moves fast — and the right advice can make a significant difference to the rate and deal you secure. Get in touch with our team to discuss your options.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage, book a consultation, or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Source: Zoopla

NatWest raises mortgage income multiple to 6 times salary for those earning over £75,000 or £100,000 joint

19th Feb 2026 • By Aaron Strutt

NatWest offering higher mortgage income multiples

NatWest is making changes to its residential Loan-to-Income (LTI) calculations, enabling many homebuyers and remortgaging customers to access larger mortgage loan sizes. The bank consistently offers many of the cheapest fixed- and tracker-rate mortgages available in the market.

Anyone applying for a NatWest mortgage earning over £75,000 or £100,000 jointly will now be able to access up to 6.0x income, up from 5.5x, provided they have a deposit of at least 25% and they have a good credit score. For single or joint applicants earning over £40,000, the income multiple is also being raised to 5.5x times salary from 5.0x again when they have a deposit of at least 25%. These changes only apply to capital and interest mortgages, although higher-income multiple interest-only mortgages are available to borrowers with a clear interest-only repayment strategy.

What this income multiple change could mean to NatWest customers: A customer earning £75,000 a year could now potentially borrow up to £37,500 more under the updated mortgage income multiple calculations than they could before this change.

Aaron Strutt, product director at Trinity Financial, says: "Nationwide recently made their 6 times multiple more widely available, so it is now an option for other borrowers, not just first-time buyers locking into five or ten-year fixes. When more of the larger lenders start offering higher income multiples, it puts pressure on the remaining lenders that don't offer such large income stretches.

"There is no point in going to a lender offering a super cheap rate if it will not offer a sufficiently large mortgage to get the property you want to buy. All of these changes to income multiples are a game-changer for the mortgage market and those keen to get on the property ladder. Many of the smaller building societies and specialist lenders have been offering up to six times salary for years, but the acceptance criteria was not widely known about."

What mortgage income multiples do the other mortgage lenders use?

- Halifax up to 5.5 times salary

- Santander up to 5.5 times salary

- Barclays up to 6 times salary

- Nationwide up to 6 times salary

- HSBC up to 6.5 times salary

- TSB up to 5.5 times salary

- Bank of Ireland up to 6 times salary

- Teachers up to 7 times salary

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage or book a consultation or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Hundreds of thousands of homebuyers could potentially benefit from increase in mortgage income multiples: FCA boss

18th Feb 2026 • By Aaron Strutt

Financial Conduct Authority (FCA) chief executive Nikhil Rathi has said that looser mortgage rules could lead to “tens of thousands and potentially hundreds of thousands” of borrowers benefiting over the course of parliament.

Mr Rathi (pictured above being interviewed on the BBC) pointed out that the reforms led to a huge increase in first-time buyers last year, and he expects recent mortgage affordability improvements to improve market conditions now that the lending rules have "flexed". He pointed out that many borrowers may not have been able to buy a home before the rules were eased, and that they have, in part, been changed after communications with the Labour government.

Speaking on the Fairer Finance podcast, Mr Rathi explained that the FCA strategy and "pillars" include market growth, reducing financial crime, helping consumers navigate their financial lives and being a smarter regulator. He also said he had warned that easing mortgage rules could cause “additional distress” if interest rates rose significantly, in a candid interview.

Mr Rathi said: "We are a world away in terms of where our market is as compared to the years before 2008, both in terms of the level of debt we have, in terms of mortgage and consumer debt. We don't have the 125% loan-to-value mortgages and interest-only is a much smaller component of the overall mortgage book compared to 20 years ago. Society has changed, and if regulation does not take account of the way the country has changed, we are not doing our job properly."

He added that the easing of lending rules was quickly implemented by many lenders and that, while the changes may lead to additional repossessions, most will benefit. "Some pay less for their mortgage than their rent, so it wasnt a question of affordability in terms of their balance sheet. There has been an average of £30,000 more in terms of mortgage borrowing and a huge increase in the number of first-time buyers."

While easing lending rules does not come without any risk, he said, “Over the cycle, over an interest rate cycle, that might mean a modest amount of additional distress if interest rates rise significantly. You can’t do both, but there are benefits and there are costs of any policy shift.”

What have the mortgage lenders changed in terms of mortgage affordability?

Banks and building societies in the UK changed their affordability criteria recently, and in some cases, it is now possible to borrow much more than in the past — but this depends on which lender you use and your income and the size of your deposit.

Most mainstream lenders historically capped how much you can borrow at around 4× to 5× your annual income, or 4× to 5× your joint income if you are buying with a partner. This means if you earn £50,000 a year, you could typically access around £250,000.

Due to regulatory changes, increased competition, and lenders wanting to help buyers purchase homes or remortgage. Some lenders, including HSBC and NatWest, have increased their maximum from around 5× to 5.5× or even 6 or 6.5× income for certain applicants who meet higher income and acceptance criteria thresholds. Regulatory relaxation of income caps, allowing lenders more flexibility and for them to issue more generous loan sizes. HSBC recently began offering up to 6.5 times salary to higher earners in a bold move that shocked many in the mortgage market and generated significant press coverage.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a more generous mortgage, book a consultation or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Mortgage Strategy - Santander lowers FTB fixes by up to 0.32%

16th Feb 2026 • By

Santander has reduced rates across all its 85% to 95% loan-to-value (LTV) first-time buyer products by up to 0.32%.

The reductions include first-time buyer rates starting from 3.92%, with a market leading 95% LTV, five-year fixed at 4.72% with no fee and 85% LTV, five-year fixed at 4.17% with £999 fee.

Trinity Financial product and communications director Aaron Strutt says: “Santander is making a real mixture of rate changes with some big price improvements for first-time buyers.”

“The bank has been offering many of the lowest fixed rates on the market for a while, so price rises were always going to come even though Nationwide cut its rates today.

“There have been some really competitively priced mortgages to choose from despite the rate increases we have seen over the last few weeks.

“The best buys now include Nationwide’s 3.54% two-year fixed rate and 3.69% three-year fix. HSBC for Intermediaries is offering five-year fixes starting from 3.79%.”

Click here to read the full story £

The i - More people are taking 5% deposit mortgages - but are they actually a good deal?

14th Feb 2026 • By

Ultra-low deposit mortgages are becoming increasingly available to first-time buyers, but experts warn there are risks involved with taking them. There were more than 500 mortgage deals on the market at the start of the month for those with just a 5 per cent deposit, according to financial analytics firm Moneyfacts.

Aaron Strutt of Trinity Financial mortgage brokers told The i: “If your only route on to the property ladder is by taking a low deposit mortgage then they are certainly worth considering, but it is also worth noting how much interest you would have to pay over the term of the mortgage.

“The amount of interest first-time buyers have to repay now that house prices and borrowing levels are so much higher can be pretty shocking. Having a longer-term plan to make overpayments as hopefully your career progresses and you earn more money, is well worth doing.”

Click here to read the full story £

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage or book a consultation or our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Thisismoney.co.uk - Santander launches 2% deposit mortgage to help first-time buyers: Is it a game changer?

3rd Feb 2026 • By

First-time buyers can now secure a mortgage with Santander with just a 2 per cent deposit, as long as it is not below £10,000.

It means an eligible buyer could purchase a £500,000 home with just a £10,000 deposit.

Santander's ‘My First Mortgage’ product is a five-year fixed rate deal, with a rate of 5.19 per cent, zero product fee and £250 cashback.

It is great to see one of the bigger banks coming out with a low deposit scheme targeting first time buyers with smaller deposits,' Aaron Strutt of broker Trinity Financial told Thisismoney.co.uk.

'There is a reasonable amount of choice in this part of the mortgage market now which means you do not need a huge deposit to buy a property anymore. The rate is not amazing, but it is not bad. For many the mortgage repayments would probably be cheaper than renting especially if they take a longer term so I suspect this will be a popular product.

'Many of the Big banks and building societies are offering income stretch mortgages or guarantor mortgages but they have shied away from deals where borrowers need less than a 5 per cent deposit.

'Santander’s new ‘my first mortgage’ product will mean it is offering similar schemes to the ones through Skipton, Yorkshire Building Society and April.'

Click here to read the full story

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage or book a consultation or our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Financial Times - Santander launches 98% mortgage for first-time buyers

3rd Feb 2026 • By

Click here to read the full story £

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage or book a consultation or our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

The Times - ‘Game-changer’ for mortgage market as banks loosen lending limits

2nd Feb 2026 • By

Two thirds of Britain’s largest mortgage lenders now offer home loans of at least six times a borrower’s salary as banks continue to loosen lending limits introduced after the 2008 financial crisis.

NatWest became the latest big bank to increase how much it would lend borrowers, with single applicants earning more than £75,000 and joint applicants on more than £100,000 able to borrow at more than six times their salary, at up to 75 per cent loan-to-value, up from 5.5 times before.

Aaron Strutt from Trinity Financial, told The Times: “When the larger lenders start offering higher income multiples it puts pressure on the remaining lenders which are not offering such large income stretches to do the same. There is no point in going to a lender offering a super cheap rate if it will not offer a sufficiently large mortgage to get the property you want to buy.

“All of these income multiple changes really are a game-changer for the mortgage market and those keen to get on the property ladder.”

Click here to read the full story £

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage, book a consultation or use our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

The Telegraph - Santander launches 98pc mortgage to fix ‘generational problem’

2nd Feb 2026 • By

One of Britain’s largest lenders has launched a 98pc mortgage in an effort to help first-time buyers with low deposits get on the housing ladder.

Santander will allow those with just £10,000 saved up to borrow as much as £500,000 over between five and 40 years, as long as they take an initial five-year fix of 5.19pc.

Aaron Strutt, of Trinity Financial, said: “If you do take a low deposit mortgage then it often makes sense to make overpayments and use the standard 10pc overpayment facilities if possible to try and reduce the LTV so it’s closer to 90pc or 95pc. This is where lots of lenders have more competitively priced rates.”

Click here to read the full story £

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a fixed or tracker rate mortgage or book a consultation or our appointment calendar

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£1.3 million mortgage offer produced in six days for clients in bidding war to buy property

1st Mar 2026 • By Aaron Strutt

Trinity Financial's broker recently helped his clients to purchase a £1.8 million property in London by securing them a £1.3 million mortgage.

The couple were moving in together and in a rush to buy because they were in a bidding war with other interested parties who also wanted the property.

What did they do for a living? Finance director and Barrister.

Did they have a complex situation? Both applicants owned their own residential properties with mortgages. They wanted to have a backup option in case the purchase fell through and they had buyers for their current homes.

As part of the mortgage process and for mortgage affordability purposes, one residential property would remain in the background in case neither is sold before the joint residential property is purchased.

Were they in a rush to complete? They needed a quick offer due to an ongoing bidding war. They had found a fantastic property they both loved and were under pressure to get the purchase completed as quickly as possible.

Why did they need our help? Affordability and service. They wanted a competitively priced rate and a lender willing to issue a £1.3 million mortgage with one property in the background. Both work in high-pressure, time-consuming roles and wanted an expert to manage their mortgage applications from start to finish.

Did we struggle to find a lender? No. Both were employed at high salaries and had strong employment records and clear credit histories.

Was the mortgage on interest-only or capital repayment? Capital repayment to age 75 of the oldest applicant. There was also the option to make lump-sum overpayments to reduce the mortgage balance faster.

Was the rate particularly good? A two-year fixed rate priced just over 3.90%.

Where did they get your details from? Referral from existing clients.

How long did it take to produce a mortgage offer? The mortgage application was submitted to a large bank on 5th August and was offered on 11th August.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Super-fast £575,000 mortgage offer secured for first-time buyers in under 24 hours

24th Feb 2026 • By

The situation

Trinity Financial's clients were buying their first home with a purchase price of £875,000. They required a £575,000 mortgage. As first-time buyers in a competitive market, securing a competitive rate with speed and certainty to support their purchase plan and move forward with confidence.

Challenges

- High property value putting pressure on affordability thresholds

- First-time buyer status requiring a tailored strategy

- Need for a competitive rate and fast lender response

Our strategy

Trinity's broker conducted a search of the mortgage market, applying his technical knowledge of lender criteria, pricing and risk appetite to determine the most suitable lender and product for his clients’ profile — including employment type, deposit size and credit history.

Despite high incomes — the main applicant, a Software Engineer; the second applicant, a homemaker — the key strategic advantage was identifying that one applicant had Premier banking status, which would unlock preferential pricing and more generous affordability calculations otherwise unavailable to many standard applicants.

After analysis of multiple lenders and potential rate options, David recommended a large high-street bank for its exceptionally competitive pricing and enhanced criteria for its Premier customers earning over £75,000.

Execution and speed

Thanks to thorough preparation and prompt documentation from our clients being uploaded onto Trinity's client portal:

- The application was submitted.

- The property was automatically valued at the time of the application, a process known as a 'desktop valuation.'

- Income and Know Your Client checks were verified extremely quickly.

- Mortgage offer issued within 24 hours.

Trinity Financial's broker detailed submission package and technical understanding of the bank's appetite meant there were minimal queries from underwriting, dramatically accelerating the process.

Outcome

- £580,000 mortgage secured at up to 6x salary.

- Sub 3.7% two-year fixed rate agreed.

- Offer issued in under 24 hours.

- No unnecessary delays — streamlined valuation and underwriting.

Why this worked

- Strategic lender selection based on client profile.

- Technical underwriting knowledge, anticipating valuation and documentation requirements.

- Leveraging banking relationships (Premier status) to access preferential pricing.

- Efficient preparation with complete and accurate submission material.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

£920,000 foreign national 15% deposit mortgage for couple to buy home in London

21st Feb 2026 • By

The situation

Our clients, a Czech and French couple, were purchasing their first home in London for £920,000. Both applicants are EU nationals living in the UK for less than three years, with no indefinite leave to remain. They are both IT professionals on skilled worker visas.

They required an 85% loan-to-value (15% depsoit) mortgage, with part of the deposit coming from France. Complicating matters further, one applicant had just started a new role and had only received a partial first pay slip.

The challenges

Although the clients had strong professional profiles, there were several key hurdles:

- Restrictions for visa holders: Many mainstream lenders cap borrowing at 75% loan-to-value for applicants without permanent residency/indefinite leave to remain.

- New employment and partial payslip: One applicant had recently changed jobs and had not yet received a full payslip, which can limit lender options and slow underwriting.

- Overseas deposit: Part of the deposit was held in France, requiring clear documentation for the source of funds and a reliable transfer route.

- High-value first-time buyer purchase: A £920,000 London purchase at 85% LTV is outside many lenders’ standard appetite for international applicants.

The solution

Following detailed research and lender comparison, we arranged the mortgage with a large bank, one of the few lenders able to support up to 90% loan-to-value for skilled worker visa applicants, subject to criteria.

- We secured an 85% loan-to-value mortgage on the £920,000 purchase.

- The clients opted for a two-year fixed rate at 3.83%.

- The bank's criteria and underwriting approach enabled us to progress the application despite the partial payslip, supported by the wider employment documentation.

- To support the overseas deposit, we introduced a trusted FX broker to manage the transfer from France efficiently and with a clear audit trail.

We also discussed contingency options. For example, if the clients had wanted to keep the funds in France for longer, alternative lenders were available as they would typically only require the funds to be in the UK prior to completion, rather than well in advance of it.

The result

The clients successfully secured a mortgage to purchase their first home in London, despite limited UK residency, no ILR, a deposit partly held overseas, and a recent employment change.

Lending solutions with Trinity Financial

If you’re buying in the UK on a visa, using overseas deposit funds, or require a lower deposit mortgage than most lenders will allow, we can help identify the right lender and structure the application for the best chance of success.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Buy-to-let remortgage on property with 80 year lease to fund home improvements on residential property

15th Feb 2026 • By

The situation

Our clients approached Trinity Financial's broker to help remortgage their buy-to-let property to release equity. The funds would be used to pay for home improvements on their residential property.

One of our clients worked at a university, the other as an engineer, and they had run into a challenge while researching mortgage options themselves.

The buy-to-let flat had 81 years remaining on the lease, which meant several lenders were unwilling to consider the property as security for a remortgage. They also wanted to increase the loan-to-value to 75% and the most competitively priced rate possible.

The challenge

Lease length can be a key factor for lenders when assessing buy-to-let properties. Many lenders prefer significantly longer leases and may decline applications where the lease is approaching 80 years.

Because of this, the client had struggled to find a lender willing to offer a sufficiently large remortgage on the property.

They wanted to raise funds from the investment property rather than borrowing against their main residence, so finding a suitable lender was essential.

The solution

After reviewing our client's situation, our adviser researched lenders across the market to identify those with more flexible criteria around lease lengths.

We were able to arrange a buy-to-let remortgage with a large bank, which was comfortable lending on the property despite the 81-year lease remaining.

The mortgage was structured as interest-only, which helped keep monthly payments lower while the property continued to generate rental income.

The outcome

The client secured a two-year fixed rate just below 3.85%, which was a competitive deal for a buy-to-let remortgage given the circumstances.

With the remortgage completed, they were able to release the funds needed to carry out improvements to their residential home. They also did not need to provide us with a work schedule to explain exactly how the money would be spent.

How did they find Trinity Financial?

The client was referred to Trinity Financial by an existing client, highlighting the value many clients place on trusted recommendations when arranging a mortgage.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Mortgage for first-time buyer contractor on visa with 10% deposit

12th Feb 2026 • By

The scenario

Our client approached us after finding a property he was keen to purchase but had previously been told by another broker that obtaining a mortgage would be very difficult due to his circumstances.

He works as a Project Manager on a fixed-term contract basis and has done so consistently for the past 24 months across multiple companies. While his income history was strong, many lenders are reluctant to consider applicants who are not in permanent employment.

In addition to this, the client was a first-time buyer, currently on a visa, and had a maximum deposit of 10% available for the purchase. Each of these factors can reduce the number of lenders willing to offer a mortgage, and combined they significantly limited the available options.

Despite this, the client had identified a property he wanted to buy and was keen to move forward, although there was no immediate urgency to complete. After being told by another broker that they couldn’t help, he continued searching for advice online and found Trinity Financial.

The challenge

The main difficulty with this case was finding a lender willing to consider the combination of:

-

Fixed-term contractor income

-

Visa status

-

First-time buyer status

-

A relatively small 10% deposit

Many lenders require permanent employment or larger deposits when applicants are on visas, which meant the available lender pool was extremely limited.

The solution

After carefully reviewing lender criteria across the market, we identified a large building society keen to consider applications under these circumstances.

We presented the client’s two-year contracting history to demonstrate stable and consistent income, helping the lender feel comfortable with the application despite the fixed-term nature of his employment.

The mortgage was arranged on a capital and interest repayment basis with an interest rate of just over 5%. While this was not the lowest rate available in the market, it represented a strong outcome given the very limited lender options.

Following submission, the lender processed the application quickly and the mortgage offer was issued within just one week.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Limited company buy-to-let purchase using funds raised from residential remortgage

1st Feb 2026 • By

The Scenario

Our clients approached us looking to purchase an investment property through a limited company buy-to-let structure as part of their ongoing property investment strategy.

Applicant one works as an accountant, while applicant two is a teacher. However, because the second applicant did not have six months of continuous employment at the time of application, they were technically recorded as unemployed for lending purposes.

Fortunately, this did not create an issue for the application as the mortgage was for a buy-to-let property, meaning affordability was primarily based on the projected rental income rather than the applicants’ personal earnings.

We had previously helped the clients complete a residential remortgage, allowing them to release equity from their home. The funds raised were then used as the deposit for this limited company investment purchase.

The clients initially discovered us through the Making Money Podcast and wanted guidance on the best strategy for expanding their property portfolio.

The challenge

While the case itself was relatively straightforward, the key objective was ensuring the clients used the funds raised from their residential remortgage in the most effective way to support their investment plans.

They were looking for a broker who could guide them through the process and identify the most competitive lender available for a limited company buy-to-let purchase.

The solution

After reviewing the available options across the market, we recommended a small building society, which offered the most competitive mortgage product suitable for the clients’ circumstances.

The mortgage was arranged on an interest-only basis, a common approach for buy-to-let investors, as it helps maximise cash flow from the property.

The clients secured a rate just below 5%, which was particularly competitive given the loan-to-value on the purchase.

Once the application was submitted, the lender moved quickly and the mortgage offer was issued in approximately six working days, an excellent turnaround time for a smaller building society.

Lending solutions with Trinity Financial

Are you looking to buy a property and require expert advice? We’re here to help you find a solution – no matter how complex your circumstances. Our expert brokers have extensive experience providing creative solutions to secure mortgages for our clients.

Call Trinity Financial on 0808 1642174 to secure a mortgage or book a consultation

The information contained within was correct at the time of publication but is subject to change.

Your mortgage is secured on your property. Your property may be repossessed if you do not keep up repayments on your mortgage

Get in touch

To arrange a meeting with one of our expert mortgage advisers complete our enquiry form or mortgage questionnaire and we will call you back. Please note, by submitting this information you have given your agreement to receive verbal contact from us to discuss your mortgage requirements.

You voluntarily choose to provide personal details to us when submitting an enquiry. Your information is confidential and held in accordance with the appropriate data protection requirements. Read Trinity Financial's privacy policy.