Up to 1.26 million people with adverse credit may need a broker: Pepper Money

Image source: Pepper Money

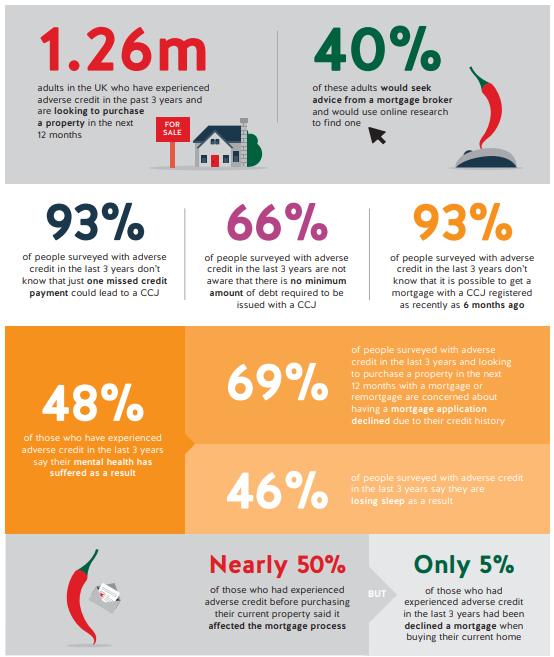

Up to 1.26 million people with an adverse credit history may be in the market for a property within the next 12 months, says broker-only lender Pepper Money.

Research conducted by YouGov on behalf of the lender concluded that 15% of the 4,163 respondents have experienced credit problems within the last three years. The figures also showed 16% of these people will be looking to purchase a house by this time next year.

Aaron Strutt, product director at Trinity Financial, says: “If you have mild adverse credit one of the bigger lenders will potentially provide you with a mortgage as long as it is declared and you pass the credit search.

“Many borrowers with missed credit card payments and even mortgage repayments will not think there is any hope of getting a mortgage. But over the last few years the adverse credit market has opened up and they are more players offering reasonably priced rates.”

CCJs or defaults more than 6 months old?

If you have a CCJ or default from more than 6 months ago, or been in a debt management plan, Trinity’s brokers may be able to help to get you a mortgage. More of the lenders are also ignoring mobile phone defaults into account.

How can we help clients?

Trinity Financial recently arranged a one-year fixed-rate mortgage for a client that missed two credit payments. The short-term fix should give provide enough time to repair her credit history ensuring we can then switch her to a lender offer cheaper rates.

We also secured a mortgage for a client who missed the most recent mortgage payment with a large bank offering the cheapest rates in the market because they had a high credit score.

Call Trinity Financial on 020 7016 0790 to secure an mild adverse credit mortgage